2025 Bitcoin Halving Impact: What to Expect

Pain Points in the Cryptocurrency Market

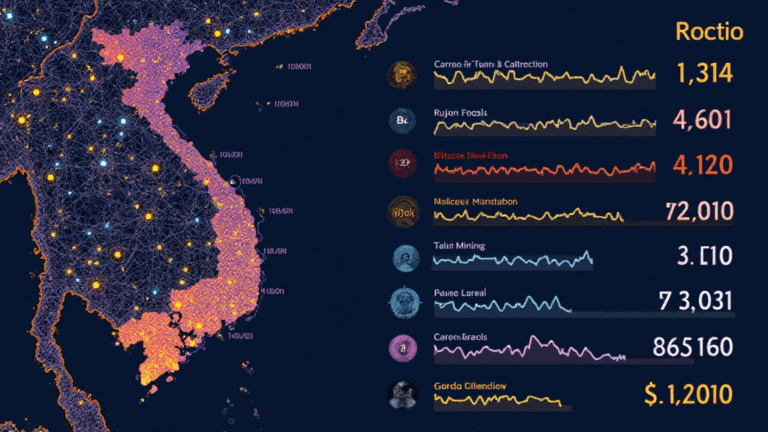

The cryptocurrency market is filled with uncertainties, leading to significant anxiety for investors. Recent fluctuations in Bitcoin’s price and the looming expectation of the 2025 Bitcoin halving impact have left many investors questioning their strategies. For example, during prior halvings, Bitcoin has often experienced dramatic price increases, yet the timing and extent of these movements are unpredictable.

In-Depth Analysis of Solutions

The best approach to navigate the 2025 Bitcoin halving impact involves understanding the market dynamics. Here’s a step-by-step breakdown of valuable methodologies:

- Market Analysis: Thoroughly monitor the historical data and price trends surrounding previous halving events.

- Portfolio Diversification: Allocate funds across multiple cryptocurrencies rather than concentrating investments solely in Bitcoin.

- Multi-Signature Verification: Ensure secure transactions by utilizing **multi-signature verification**, which adds an extra layer of security for your investments.

Comparison of Strategies

| Parameter | Strategy A: Bitcoin Investment | Strategy B: Altcoin Diversification |

|---|---|---|

| Security | Moderate | High |

| Cost | High | Low |

| Application Scenario | Long-term hold | Short-term trading |

According to a recent Chainalysis report, the expected volatility in the market post-halving could see Bitcoin prices surge as much as 40%, reminiscent of trends observed in previous years.

Risk Warnings

While the 2025 Bitcoin halving impact might present lucrative opportunities, it is vital to acknowledge potential risks. **Ensure to conduct comprehensive market research** before any investment, and never invest more than you can afford to lose. Careful planning and assessment can prevent significant financial losses.

At bitcoinstair, we strive to keep our users informed about the latest trends and impactful events in the cryptocurrency sector. With our expert insights and analysis, you can navigate the volatile waters of crypto investments with confidence.