Exploring Crypto Portfolio Tracker in Vietnam: A 2025 Outlook

Understanding Crypto Portfolio Trackers

Crypto portfolio trackers are like the financial statement for your cryptocurrency investments. They help you see the big picture in real-time, just like a store manager keeps an eye on inventory. In Vietnam, where the crypto market is becoming increasingly popular, having a suitable tracker can mean the difference between a profitable investment and a financial loss.

Why are Portfolio Trackers Essential for Investors?

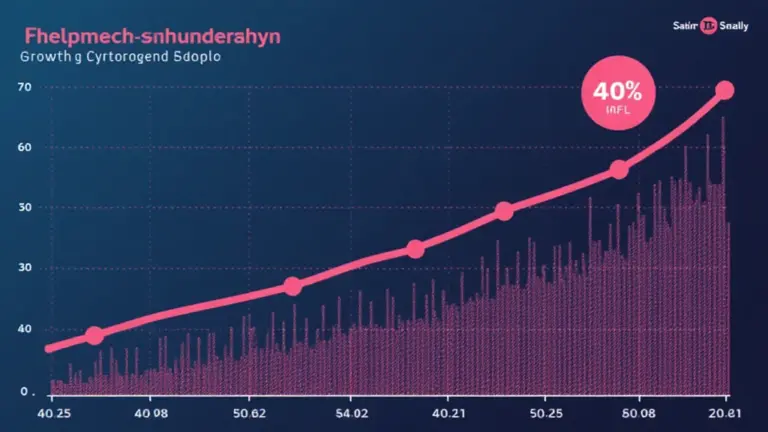

With such a booming interest in cryptocurrencies, you might have realized it’s hard keeping track of your assets. Think of a crypto portfolio tracker as your personal accountant. In 2025, the Vietnam government is likely to impose stricter regulations on crypto investments. Hence, accurately tracking your portfolio will help you comply with taxation and reporting requirements.

Key Features to Look for in a Crypto Portfolio Tracker

When choosing a crypto portfolio tracker, there are essential features to consider. For instance, real-time updates are crucial, just like daily stock reviews. Additionally, security should be top-notch—after all, you wouldn’t leave your house unlocked. Look for trackers that offer two-factor authentication and wallet integration to protect your assets.

How to Optimize Your Investments Using Trackers

Using a crypto portfolio tracker can help you optimize your investments effectively. A good analogy here is adjusting your shopping list based on what’s on sale. By analyzing your performance through these tools, you can make data-driven decisions to buy, sell, or hold your cryptocurrencies. Plus, understanding market trends will allow you to capitalize on potential profits.

In summary, as 2025 approaches, the importance of utilizing tools like a crypto portfolio tracker in Vietnam cannot be overstated. With regulations tightening and market opportunities evolving, being prepared is crucial to safeguard your investments.

Download Your Crypto Portfolio Management Toolkit!

To enhance your investment strategy and effectively manage your cryptocurrency portfolio, download our comprehensive toolkit today!