Crypto Tax Deduction Vietnam: Navigating New Regulations

Crypto Tax Deduction Vietnam: Navigating New Regulations

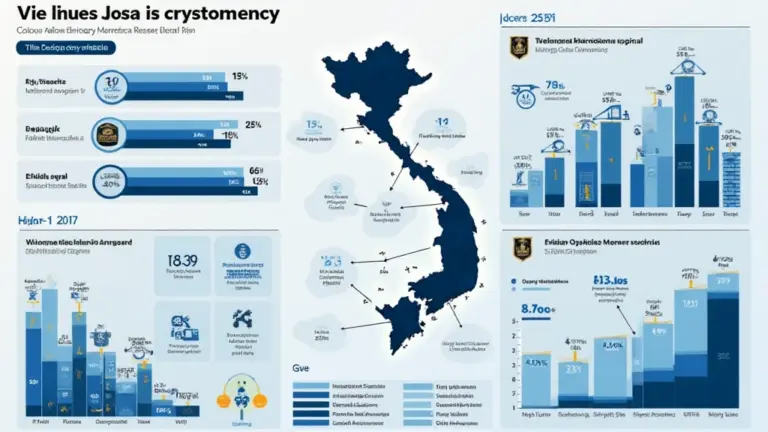

According to Chainalysis 2025 data, over 60% of Vietnamese crypto investors are unaware of their tax obligations. With changing regulations in Vietnam, understanding crypto tax deductions has never been more crucial.

What are Crypto Tax Deductions in Vietnam?

Imagine you’re going to a market and every time you buy a bunch of bananas, you have to pay a tax on them. Now, if you bought them at a discount or traded them for apples, there are ways to claim some of that tax back. Similarly, in Vietnam, crypto tax deductions allow investors to reclaim some taxes paid on their crypto transactions under specific conditions.

Who Needs to Be Aware of These Deductions?

If you’re actively trading Bitcoin, Ethereum, or other cryptocurrencies, you might be eligible for deductions. Think of each trade as buying a batch of goods at different prices. When you sell them, knowing what you paid can help you calculate how much tax you could possibly deduct. It’s crucial to keep accurate records of your transactions for this.

How to Claim Crypto Tax Deductions?

Claiming deductions can be as straightforward as filling out a form. Let’s say you keep all your receipts from the market. Similarly, in the crypto world, keeping transaction records is key. You’ll need your trading history and documentation to substantiate your claims. This helps avoid any possible disputes with the tax authorities.

What Are the Challenges in Understanding Crypto Taxes?

Crypto taxes can feel like trying to buy a cup of coffee but only getting a confusing menu of items. Many investors are unsure of how to interpret the regulations. It may be beneficial to consult with a financial advisor to demystify the tax implications of your crypto activities in Vietnam.

In conclusion, understanding Crypto tax deduction Vietnam is essential for anyone involved in the crypto market. Keeping records, understanding the eligibility for deductions, and possibly consulting a professional can save you time and money.

For further guidance, check out our tax toolkit designed to assist you in navigating your crypto tax obligations. Download the toolkit below!