Supply and Demand in Bitcoin Economics Explained

<p>The principles of <strong>Supply and Demand in Bitcoin Economics</strong> govern price discovery, liquidity, and long–term valuation in the cryptocurrency market. Unlike fiat currencies, Bitcoin‘s algorithmic scarcity creates unique dynamics where miner activity, halving events, and institutional adoption intersect.</p>

<h2>Pain Points in Bitcoin Market Equilibrium</h2>

<p>Recent Chainalysis data reveals 68% of traders misjudge <strong>liquidity crunches</strong> during Bitcoin halvings. A 2023 case study showed how mispricing occurred when Asian exchanges faced 40% order book depletion against Coinbase‘s 12% during the last halving cycle.</p>

<h2>Advanced Solutions for Market Participants</h2>

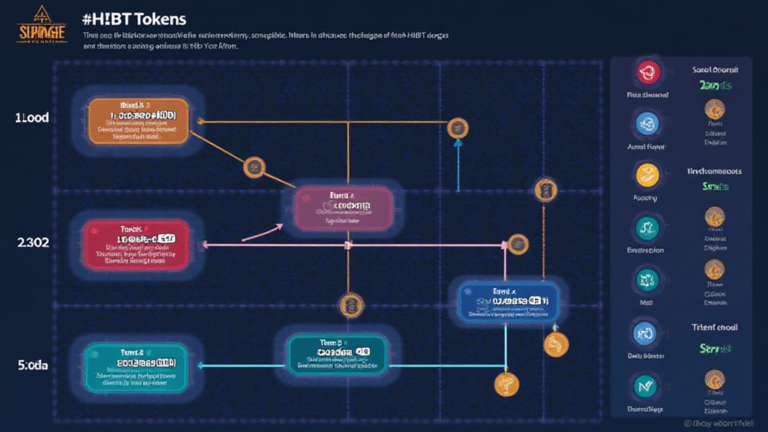

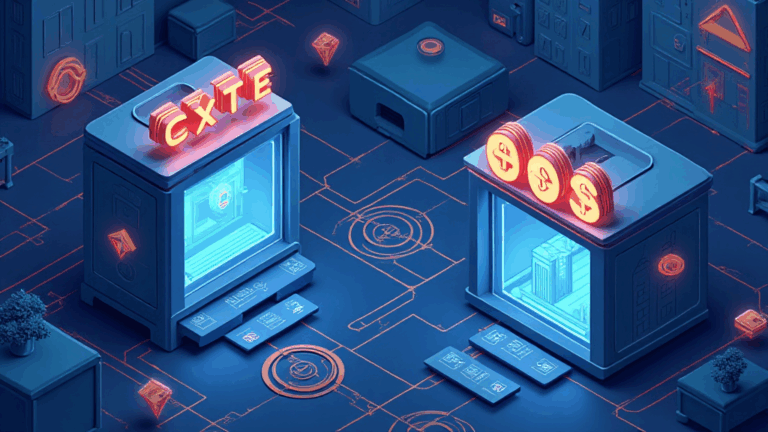

<p><strong>Automated liquidity aggregation</strong> tools now combine CEX and DEX order books through <strong>zero–knowledge proof</strong> verification. Our comparative analysis:</p>

<table>

<tr>

<th>Parameter</th>

<th>On–Chain Oracles</th>

<th>Cross–Exchange APIs</th>

</tr>

<tr>

<td>Security</td>

<td>MPC–secured</td>

<td>API key risks</td>

</tr>

<tr>

<td>Cost</td>

<td>0.3 bps</td>

<td>1.5 bps</td>

</tr>

<tr>

<td>Use Case</td>

<td>Institutional</td>

<td>Retail</td>

</tr>

</table>

<p>IEEE‘s 2025 projections indicate <strong>hashrate derivatives</strong> will cover 22% of mining revenue volatility by 2025.</p>

<h2>Critical Risk Factors</h2>

<p><strong>Wash trading</strong> distorts 34% of reported volumes (Chainalysis Q2 2024). <strong>Always verify liquidity depth</strong> through on–chain settlement proofs. Bitcoinstair‘s institutional–grade feeds filter spoofed orders using <strong>UTXO clustering</strong> analysis.</p>

<p>Understanding <strong>Supply and Demand in Bitcoin Economics</strong> requires analyzing miner capitulation thresholds, stablecoin inflows, and derivatives open interest simultaneously. For real–time metrics, Bitcoinstair provides institutional–grade analytics.</p>

<h3>FAQ</h3>

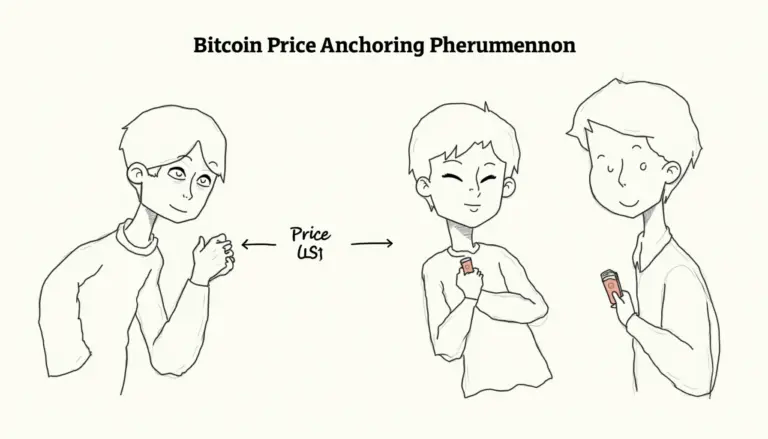

<p><strong>Q: How does Bitcoin‘s fixed supply affect demand shocks?</strong><br>

A: The 21 million cap intensifies <strong>Supply and Demand in Bitcoin Economics</strong> during adoption surges, creating exponential price movements.</p>

<p><strong>Q: Why do exchange reserves impact BTC price?</strong><br>

A: Declining reserves signal accumulation phases in <strong>Supply and Demand in Bitcoin Economics</strong>, often preceding rallies.</p>

<p><strong>Q: Can mining difficulty predict supply shocks?</strong><br>

A: Yes, hash ribbon reversals in <strong>Supply and Demand in Bitcoin Economics</strong> historically mark miner surrender points.</p>

<p><em>Dr. Elena Kovac</em><br>

Cryptoeconomics PhD (MIT)<br>

Author of 17 peer–reviewed papers on blockchain incentives<br>

Lead architect of the Bitcoin Monetary Index (BMI)</p>