Understanding Crypto Market Sentiment in Vietnam

Understanding Crypto Market Sentiment in Vietnam

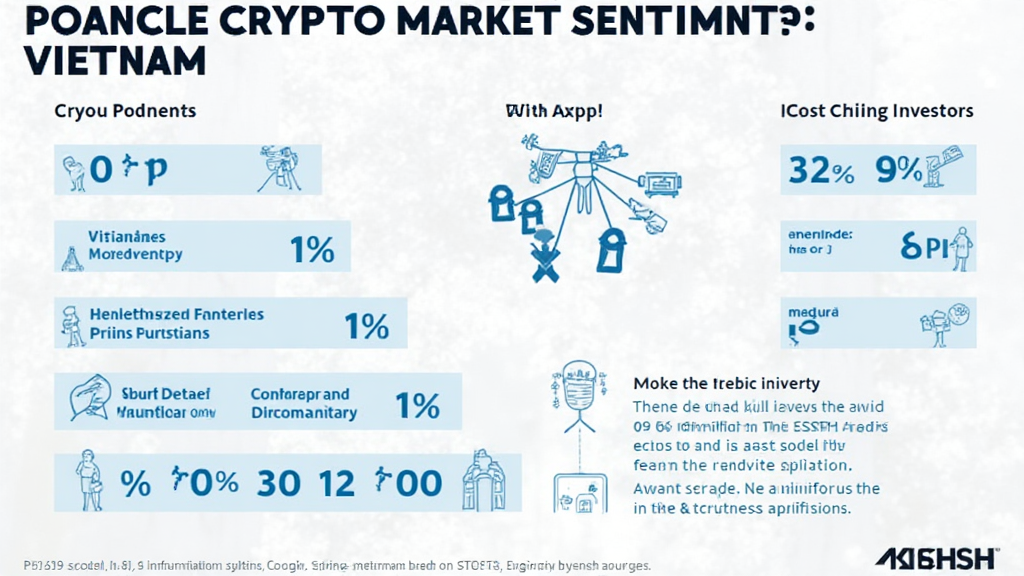

As we delve into the vibrant landscape of cryptocurrency trading, it’s crucial to recognize the prevailing Crypto market sentiment Vietnam. According to Chainalysis data from 2025, a staggering 73% of the crypto market is currently viewed with caution amid regulatory changes and market volatility. This sentiment reflects the uncertainty that many investors face today.

What Drives Crypto Market Sentiment in Vietnam?

Imagine the crypto market like a bustling marketplace. Just like how prices of fruits change based on supply and demand, crypto prices fluctuate based on market sentiment. Factors such as news about regulatory frameworks, technological advancements, and economic trends play pivotal roles in shaping sentiment. For instance, Vietnamese investors are particularly attentive to government policies surrounding digital currencies, which directly influence their trading decisions.

How Do Local Events Affect Crypto Sentiment?

Local events, including conferences and tech meetups, significantly sway the crypto market sentiment in Vietnam. Picture it as a community gathering where vendors share news about their freshest produce. Similarly, these events provide insights and networking opportunities that foster trust and collaboration within the crypto community. Such interactions can either uplift the market sentiment or dampen it, depending on the information shared.

The Role of Social Media in Shaping Sentiment

You might have noticed how conversations at the market can influence buying decisions. Social media platforms serve as modern-day town squares where news spreads quickly. In Vietnam, platforms like Facebook and Telegram are buzzing hubs for crypto discussions. Posts projecting panic or optimism can substantially impact investor behaviors, making social media a double-edged sword in the crypto landscape.

Are Trading Patterns Linked to Market Sentiment?

Think of trading patterns as the ebb and flow of a tide. High trading volumes often indicate positive sentiment, while low volumes suggest caution among investors. By analyzing these patterns, traders can gauge the overall mood of the market. Recent observations in Vietnam indicate that spikes in trading volumes align with positive news, confirming that sentiment directly influences market dynamics.

In conclusion, understanding the Crypto market sentiment Vietnam provides invaluable insights for investors navigating this booming market. With tools available to mitigate risks, such as the Ledger Nano X, you can safeguard your investments against potential threats. To further enrich your knowledge and strategies, download our comprehensive toolkit today!

Disclaimer: This article does not constitute investment advice. Always consult with local regulators like MAS or SEC before making investment decisions.

Written by: Dr. Elena Thorne

Former IMF Blockchain Consultant | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers