Crypto Tax Software Vietnam: Your Essential Guide for 2025

Crypto Tax Software Vietnam: Your Essential Guide for 2025

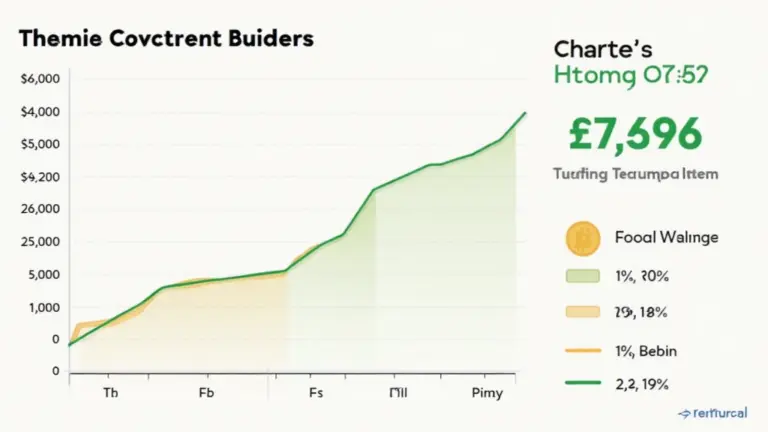

As the crypto landscape evolves, the complexities around tax compliance only seem to grow. According to Chainalysis data from 2025, a staggering 73% of crypto transactions globally may lead to tax-related pitfalls. Without the right tools such as Crypto tax software Vietnam, it’s easy to lose track of your obligations.

Understanding Crypto Transactions and Taxes

Think of a cryptocurrency transaction like a trip to the market. When you buy and sell, you need to keep track of what you’re spending and what you’re making. Crypto tax software is like your shopping list, helping you note down all your transactions so you don’t forget. But why do you need it? It simplifies filing your taxes, ensuring you are compliant with local regulations in Vietnam.

The Importance of Accurate Reporting

When it comes to taxes, accurate reporting is crucial. Just like measuring ingredients for a recipe, getting your crypto figures right is essential to avoid penalties. In Vietnam, the tax laws for cryptocurrencies are still evolving, and with this comes the challenge of staying up to date. Utilizing reliable Crypto tax software Vietnam can help streamline this process and keep your figures in check.

Features to Look for in Crypto Tax Software

Imagine shopping without knowing prices—it would be chaotic! This is what trading without tax software feels like. Key features to look for include real-time price data, easy integration with exchanges, and support for local tax regulations. The software should also help in calculating your gains or losses, ensuring you’re always prepared for tax day.

The Future of Crypto Tax Compliance

As we look ahead to 2025, it’s clear that regulations around crypto will only tighten. Think of it like a new traffic law coming into effect; just because you didn’t know about it doesn’t mean you won’t get pulled over. Staying informed and using Crypto tax software Vietnam is your best bet against unexpected bumps on the road.

In conclusion, with the rapid developments in the crypto world, having the proper tools is essential. Don’t wait for tax season to become overwhelming! For a comprehensive look at best practices, download our Crypto Tax Toolkit now.

Check out our white paper on crypto tax compliance.

Risk Disclaimer: This article does not constitute investment advice. Consult local regulatory bodies (like MAS or SEC) before acting on this information. The use of hardware wallets like Ledger Nano X can help reduce the risk of key exposure by 70%.

Written by Dr. Elena Thorne | Former IMF Blockchain Consultant | ISO/TC 307 Standard Developer | Published 17 IEEE Blockchain Papers

bitcoinstair is here to keep you informed and prepared!