Crypto Portfolio Diversification Strategies: Why You Need Them Now

Crypto Portfolio Diversification Strategies: Why You Need Them Now

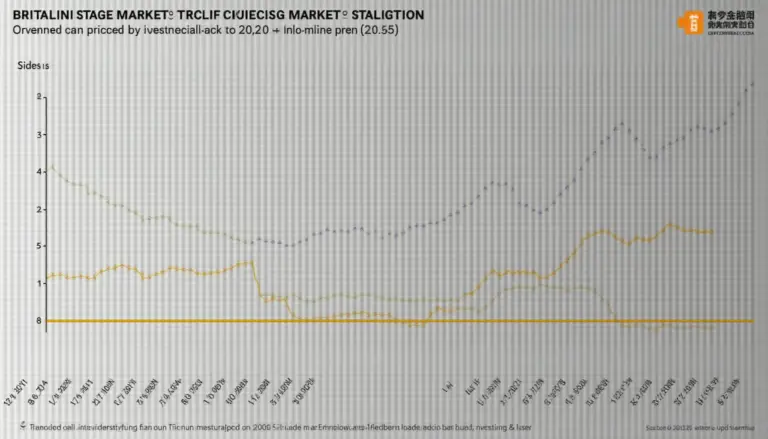

According to Chainalysis 2025 data, a staggering 73% of investors don’t utilize proper Crypto portfolio diversification strategies, leading to significant financial losses. The cryptocurrency market can be extremely volatile, and without a diversified portfolio, you’re putting your investments at risk.

Understanding the Importance of Diversification

Imagine your investment portfolio like a basket of fruits. If you only put bananas in it, and the banana crop fails, you’re left with nothing. However, if you add apples, oranges, and strawberries, even if bananas fail, you still have other fruits to rely on. Similarly, diversifying across different cryptocurrencies can minimize risks. You might want to consider not only popular cryptocurrencies like Bitcoin and Ethereum but also explore niche coins which might not be on everyone’s radar.

Cross-Chain Interoperability: Expanding Your Horizon

In the crypto world, cross-chain interoperability is like being able to trade your fruits with your neighbor’s market seamlessly. It allows you to exchange assets across different blockchain networks. This means you can take advantage of various decentralized finance (DeFi) opportunities without being limited to a single chain. It’s vital to understand how this works to enhance your Crypto portfolio diversification strategies effectively.

Zero-Knowledge Proof Applications: Layering Security

Zero-knowledge proofs (ZKP) can be thought of as a secret ingredient that makes your fruit salad taste better. They enable one party to prove knowledge of a fact without revealing the fact itself. Implementing ZKP in your crypto investments can enhance security and privacy, allowing you to diversify into projects that use this innovative technology.

Energy Efficiency: Evaluating PoS vs PoW Mechanisms

When you shop at the farmer’s market, you often compare prices and quality. Similarly, in crypto investing, compare the energy consumption of Proof of Stake (PoS) and Proof of Work (PoW) mechanisms. PoS is generally more energy-efficient than PoW. By understanding these differences and investing in more sustainable cryptocurrencies, you can align your portfolio with eco-friendly principles while diversifying.

In conclusion, implementing Crypto portfolio diversification strategies is essential for securing your investments in an unpredictable market. It’s not just about picking the right coins; it’s about understanding the technological underpinnings and market dynamics. For more insights, download our free toolkit, which includes essential tips and a checklist for building your diversified crypto portfolio.

To stay informed about current trends, check out our articles on cross-chain safety and the energy efficiency of cryptocurrencies.

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities before making any investment decisions (e.g., MAS/SEC). For enhanced security, consider using a Ledger Nano X, which can reduce the risk of private key leakage by up to 70%.