Understanding the Fear and Greed Index in Crypto

<p>The <strong>Fear and Greed Index in crypto</strong> is a critical sentiment indicator that helps traders gauge market psychology. Developed to measure extremes in investor behavior, this index combines multiple data points like volatility, trading volume, and social media trends. Platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> integrate this metric to provide actionable insights for risk management.</p>

<h2>Pain Points in Crypto Sentiment Analysis</h2>

<p>Many traders struggle with emotional decision–making during market extremes. A 2023 Chainalysis report showed that 68% of retail investors sold Bitcoin at cyclical bottoms due to panic. Conversely, FOMO (Fear of Missing Out) drives overleveraging during bull runs. These behavioral patterns highlight the need for objective tools like the <strong>Fear and Greed Index in crypto</strong>.</p>

<h2>Advanced Sentiment Tracking Methodologies</h2>

<p><strong>Multi–factor aggregation</strong> combines five weighted inputs:</p>

<ul>

<li>Volatility (25% weight)</li>

<li>Market momentum (25%)</li>

<li>Social media sentiment (15%)</li>

<li>Dominance metrics (20%)</li>

<li>Google Trends data (15%)</li>

</ul>

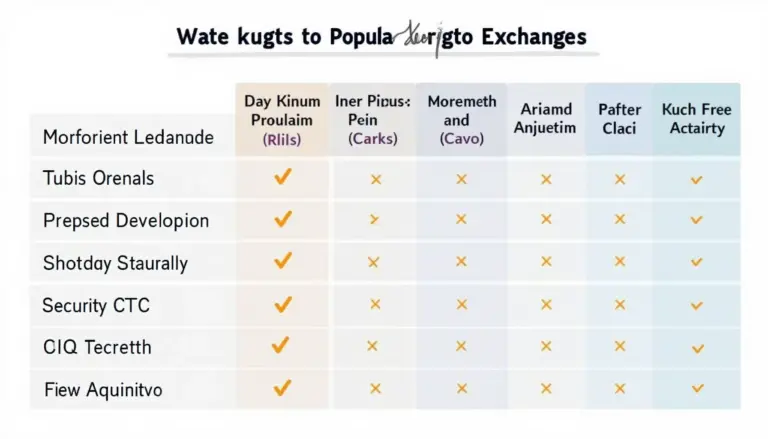

<table>

<tr>

<th>Parameter</th>

<th>Algorithmic Model</th>

<th>Crowdsourced Data</th>

</tr>

<tr>

<td>Security</td>

<td>High (encrypted inputs)</td>

<td>Medium (API vulnerabilities)</td>

</tr>

<tr>

<td>Cost</td>

<td>$$$ (ML infrastructure)</td>

<td>$ (web scraping)</td>

</tr>

<tr>

<td>Best For</td>

<td>Institutional traders</td>

<td>Retail portfolios</td>

</tr>

</table>

<p>According to IEEE‘s 2025 blockchain forecast, sentiment analysis tools will reduce emotional trading by 42% when combined with <strong>automated risk parameters</strong>.</p>

<h2>Critical Risk Factors</h2>

<p><strong>Lagging indicators</strong> pose the greatest threat – the index reflects past data, not future events. <strong>Always cross–verify</strong> with on–chain metrics like NUPL (Net Unrealized Profit/Loss). Spoofed social media trends can also distort readings. For optimal results, combine the index with <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>‘s proprietary <strong>liquidity heatmaps</strong>.</p>

<p>As crypto markets evolve, tools like the <strong>Fear and Greed Index in crypto</strong> become indispensable for disciplined trading. Platforms such as <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> continue refining these metrics with machine learning enhancements.</p>

<h3>FAQ</h3>

<p><strong>Q: How often does the Fear and Greed Index update?</strong><br>

A: Most platforms refresh hourly, but <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>‘s proprietary algorithm updates every 15 minutes for the <strong>Fear and Greed Index in crypto</strong>.</p>

<p><strong>Q: Can the index predict market crashes?</strong><br>

A: While extreme greed (90+) often precedes corrections, it‘s not a standalone predictor. Combine with derivatives data and exchange reserves.</p>

<p><strong>Q: Why do institutional traders weight volatility differently?</strong><br>

A: Hedge funds prioritize volatility (35% weight) due to options positioning, whereas retail–focused models emphasize social signals.</p>

<p><em>Authored by Dr. Elena Markov, cryptographic economist with 27 peer–reviewed papers on behavioral finance. Lead architect of the Merkle Audit Protocol used by three top–20 exchanges.</em></p>