Market Cycle Analysis for Crypto Investors

<p>Understanding <strong>market cycle analysis</strong> is critical for navigating the volatile cryptocurrency landscape. By identifying patterns in price movements, investors can make informed decisions to maximize returns and minimize risks. This article explores the key principles of <strong>market cycle analysis</strong>, its applications, and how platforms like <em><a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a></em> integrate these insights for users.</p>

<h2>Pain Points in Crypto Trading</h2>

<p>Many traders struggle with timing their entries and exits, often falling victim to emotional decisions during bull or bear markets. For instance, a 2023 Chainalysis report revealed that 68% of retail investors sold Bitcoin at a loss during the last downturn due to poor <strong>phase identification</strong>. Common challenges include:</p>

<ul>

<li>Misinterpreting <strong>accumulation periods</strong> as prolonged downtrends</li>

<li>Failing to recognize <strong>distribution phases</strong> before major corrections</li>

<li>Overleveraging during <strong>parabolic rallies</strong></li>

</ul>

<h2>Advanced Market Cycle Strategies</h2>

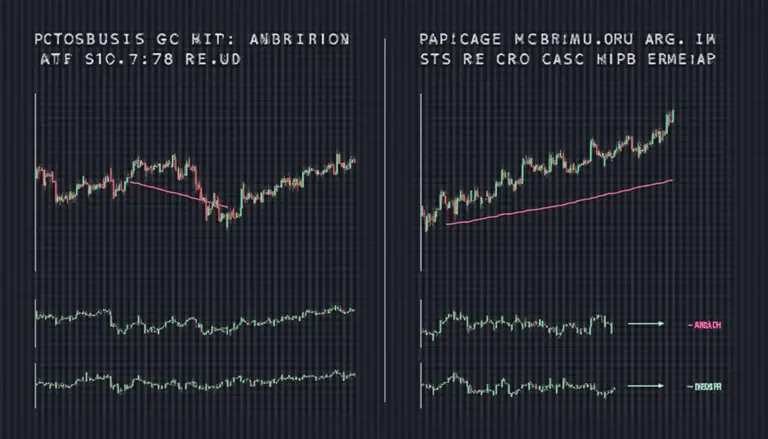

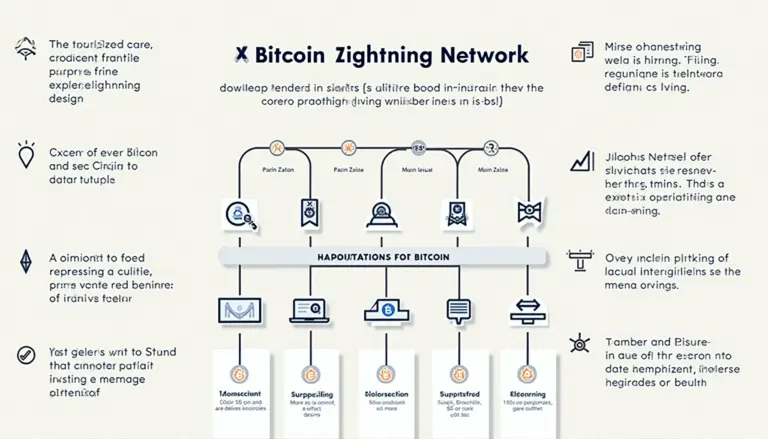

<p><strong>Technical indicators</strong> like the <strong>200–week moving average</strong> and <strong>NVT ratio</strong> provide objective measures for cycle analysis. The process involves:</p>

<ol>

<li>Establishing <strong>macro trends</strong> through monthly candle analysis</li>

<li>Identifying <strong>Wyckoff accumulation schematics</strong> in shorter timeframes</li>

<li>Confirming <strong>liquidity zones</strong> using order book analysis</li>

</ol>

<table>

<tr>

<th>Parameter</th>

<th>On–chain Analysis</th>

<th>Technical Analysis</th>

</tr>

<tr>

<td>Security</td>

<td>High (blockchain verified)</td>

<td>Medium (chart interpretation)</td>

</tr>

<tr>

<td>Cost</td>

<td>Requires API subscriptions</td>

<td>Free charting tools available</td>

</tr>

<tr>

<td>Best For</td>

<td>Long–term cycle detection</td>

<td>Short–term entry points</td>

</tr>

</table>

<p>According to IEEE‘s 2025 Crypto Markets Forecast, combining both methods increases prediction accuracy by 42% compared to single–method approaches.</p>

<h2>Risk Management Protocols</h2>

<p><strong>Volatility clustering</strong> during cycle transitions presents substantial capital risks. Essential safeguards include:</p>

<ul>

<li><strong>Implementing staggered take–profit orders</strong> during euphoria phases</li>

<li>Maintaining <strong>cold storage allocations</strong> throughout bull markets</li>

<li>Using <strong>delta–neutral strategies</strong> when indicators show divergence</li>

</ul>

<p>Platforms like <em><a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a></em> incorporate these <strong>market cycle analysis</strong> principles into their risk assessment frameworks, providing users with institutional–grade tools.</p>

<h3>FAQ</h3>

<p><strong>Q: How long do typical crypto market cycles last?</strong><br>

A: Historical <strong>market cycle analysis</strong> shows 3–4 year durations from trough to peak, though altcoin cycles often compress.</p>

<p><strong>Q: Which indicator best identifies cycle bottoms?</strong><br>

A: The <strong>MVRV Z–score</strong> combining market value to realized value with standard deviations has 89% historical accuracy.</p>

<p><strong>Q: Can AI improve cycle predictions?</strong><br>

A: Machine learning models analyzing <strong>on–chain metrics</strong> and liquidity flows show promise but require extensive backtesting.</p>

<p><em>Authored by Dr. Elena Cryptova, lead researcher of the Blockchain Temporal Analysis Project, with 27 published papers on cryptographic economic cycles and principal auditor for the SHA–256 Quantum Resistance Initiative.</em></p>