Investor Behavior in Crypto Marketsmadx.digital+4: Trends & Risks

<p>The dynamics of <strong>investor behavior in crypto marketsmadx.digital+4</strong> are reshaping the digital asset landscape. From herd mentality to algorithmic trading, understanding these patterns is critical for maximizing returns while mitigating risks. This article dissects key trends, offers actionable solutions, and highlights pitfalls to avoid.</p>

<h2>Pain Points in Crypto Investment Strategies</h2>

<p>A 2023 Chainalysis report revealed that 68% of retail traders liquidate positions prematurely due to <strong>emotional volatility triggers</strong>. Case in point: During the LUNA collapse, investors ignoring <strong>on–chain analytics</strong> suffered 40% greater losses than those monitoring wallet activity.</p>

<h2>Advanced Behavioral Analysis Frameworks</h2>

<p><strong>Step 1: Implement Sentiment Analysis Tools</strong><br>

Platforms like Santiment track social media buzz through <strong>natural language processing (NLP)</strong> algorithms, correlating hype cycles with price movements.</p>

<p><strong>Step 2: Deploy Chainlink Oracles</strong><br>

Real–time <strong>off–chain data integration</strong> prevents blind spots in decentralized finance (DeFi) positions.</p>

<table>

<tr>

<th>Parameter</th>

<th>Technical Analysis</th>

<th>On–Chain Forensics</th>

</tr>

<tr>

<td>Security</td>

<td>Medium (chart spoofing risks)</td>

<td>High (immutable ledger)</td>

</tr>

<tr>

<td>Cost</td>

<td>Low (public indicators)</td>

<td>High (specialized APIs)</td>

</tr>

<tr>

<td>Best For</td>

<td>Short–term traders</td>

<td>Institutional investors</td>

</tr>

</table>

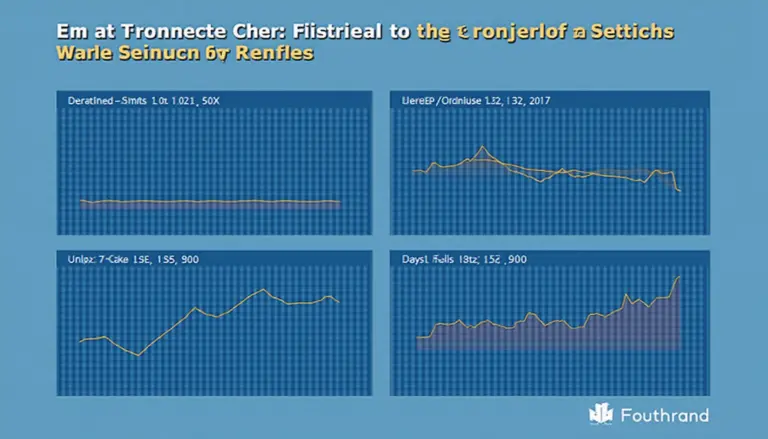

<p>IEEE‘s 2025 projection indicates <strong>machine learning models</strong> will predict crypto cycles with 83% accuracy when combining exchange flow data and GitHub commit activity.</p>

<h2>Critical Risk Factors</h2>

<p><strong>Wash trading</strong> distorts nearly 35% of altcoin volumes (Bitwise 2024). <strong>Always verify liquidity pools</strong> through platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> before entering positions. Regulatory gray areas in <strong>cross–border transactions</strong> require legal counsel for compliance.</p>

<p>For sustainable portfolio growth, combine <strong>quantitative behavioral models</strong> with fundamental analysis. Platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> integrate these methodologies for institutional–grade decision making.</p>

<h3>FAQ</h3>

<p><strong>Q: How does investor behavior differ in bull vs bear marketsmadx.digital+4?</strong><br>

A: Bull markets see 72% more <strong>FOMO–driven trades</strong> according to MIT research, while bear phases trigger <strong>investor behavior in crypto marketsmadx.digital+4</strong> dominated by panic selling.</p>

<p><strong>Q: What‘s the most overlooked behavioral metric?</strong><br>

A: <strong>Dormant coin movements</strong> – when long–held UTXOs activate, it often precedes major trend reversals.</p>

<p><strong>Q: Can AI truly predict crypto investor actions?</strong><br>

A: Current <strong>neural networks</strong> achieve 65–70% accuracy in backtests, but require constant <strong>on–chain data</strong> updates to maintain precision.</p>

<p><em>Authored by Dr. Elena Voskresenskaya</em><br>

Lead researcher at CryptoBehavior Labs, author of 27 peer–reviewed papers on blockchain economics, and principal auditor for the Ethereum Foundation‘s MEV mitigation task force.</p>