Bitcoin AML Policies in Vietnam: Ensuring Compliance in 2025

Bitcoin AML Policies in Vietnam: Ensuring Compliance in 2025

According to Chainalysis data from 2025, a staggering 73% of cryptocurrency exchanges exhibit vulnerabilities that could be exploited for money laundering. This brings the focus on Vietnam’s Bitcoin Anti-Money Laundering (AML) policies and compliance measures that are needed to strengthen the integrity of the crypto industry.

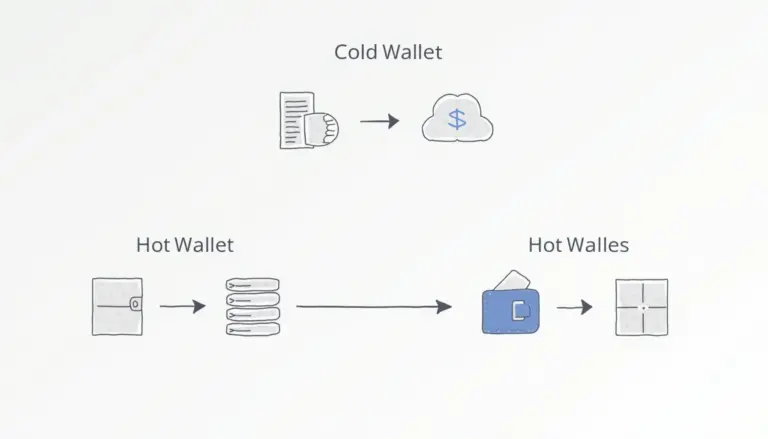

Understanding Bitcoin AML Policies in Vietnam

Think of Bitcoin AML policies like the gatekeepers at a club. Just like they check your ID before letting you in, these policies scrutinize transactions to prevent illicit activities. Vietnam is ramping up its regulations to ensure that cryptocurrency exchanges and users comply with global standards.

The Role of Compliance in Protecting Investors

The importance of compliance can’t be overstated. Imagine a neighborhood watch ensuring everyone’s safety—this is what compliance does for the crypto market. Regulations help foster trust, encouraging more users to invest in Bitcoin and other digital currencies while keeping fraudsters at bay.

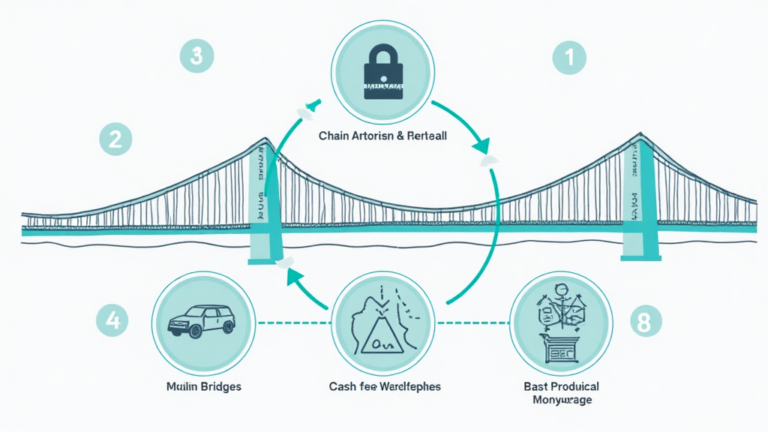

Cross-Chain Interoperability and Its Regulatory Implications

Cross-chain interoperability can be likened to a translation service at an airport. Just as it helps different languages communicate, it allows various blockchain systems to interact. Vietnam needs to establish robust AML policies to regulate these interactions and minimize risks associated with unregulated asset transfers.

Zero-Knowledge Proof Applications in AML Compliance

Zero-knowledge proofs are somewhat like showing someone your ticket to enter a concert without revealing your entire identity. These applications provide authentication without exposing user data, thus enhancing privacy while still ensuring compliance with AML regulations in Vietnam.

In conclusion, Bitcoin AML policies in Vietnam compliance is crucial for securing the digital asset landscape. With tools like the Ledger Nano X, which can significantly reduce the risk of private key exposure by 70%, investors can safeguard their assets more effectively. For more information, download our cryptocurrency safety toolkit.