Unlocking Bitcoin Rebalancing Automation in Vietnam

Unlocking Bitcoin Rebalancing Automation in Vietnam

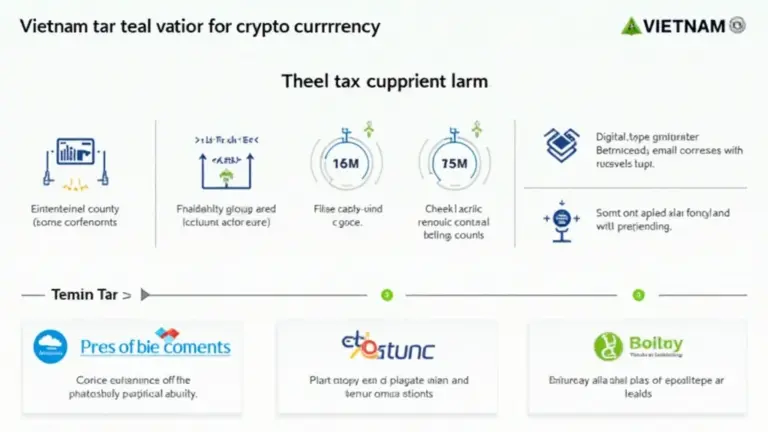

With over 73% of digital assets facing volatility risks in 2025, effective strategies are essential for maintaining a resilient cryptocurrency portfolio. Bitcoin rebalancing automation Vietnam offers a robust solution to ensure your holdings are strategically managed, minimizing risk while maximizing growth potential.

What is Bitcoin Rebalancing Automation?

Imagine a market stall where fruits are balanced based on demand. Similarly, Bitcoin rebalancing automation allows traders to adjust their cryptocurrency portfolios dynamically, ensuring that exposure remains aligned with personal investment goals. This technique not only mitigates risk but also optimizes returns during market fluctuations.

Why is It Important for Vietnamese Investors?

In Vietnam, the cryptocurrency market is burgeoning. Therefore, understanding the implications of Bitcoin rebalancing automation is crucial. As the market matures, Vietnamese traders can leverage automated tools to maintain balance in their digital asset portfolio, adapting quickly to changes without constant manual intervention.

Benefits of Automation in Bitcoin Trading

Just like a rice cooker simplifies cooking, automated rebalancing simplifies portfolio management. It allows for timely adjustments based on market performance, ensuring that your investments are working as efficiently as possible. This tool can help Vietnamese investors allocate their funds wisely, reacting to market trends without being tethered to their screens.

How to Get Started?

Starting with Bitcoin rebalancing automation in Vietnam is as easy as setting up an online shopping account. Investors can explore various platforms that provide automation features tailored to their specific trading needs. Getting informed through reliable sources like hibt.com helps in selecting the right tools.

In summary, Bitcoin rebalancing automation Vietnam equips investors with the ability to navigate through an increasingly complex cryptocurrency landscape. By adopting these automated strategies, traders can enhance their investment efficiency while staying aligned with market trends. For further resources, don’t forget to download our toolkit to streamline your trading strategies.