2025 Cross-Chain Interoperability: Best Practices

2025 Cross-Chain Interoperability: Best Practices

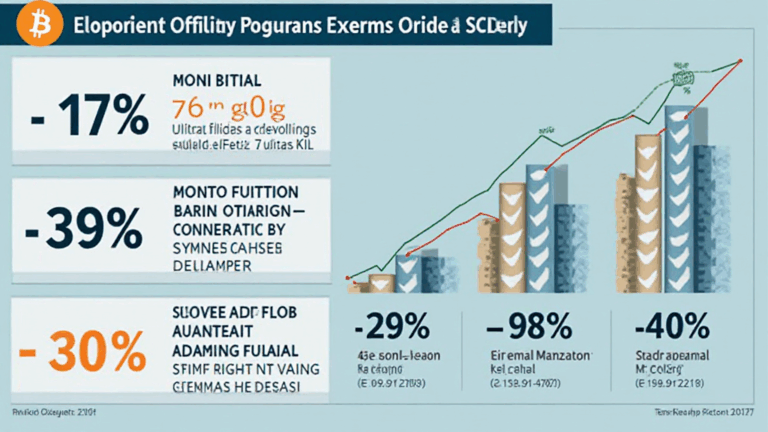

According to Chainalysis, a staggering 73% of cross-chain bridges are currently vulnerable to security threats. As blockchain technology matures, the focus on seamless transactional processes between different chains grows. This article breaks down essential elements of cross-chain interoperability and shares vital insights to enhance security.

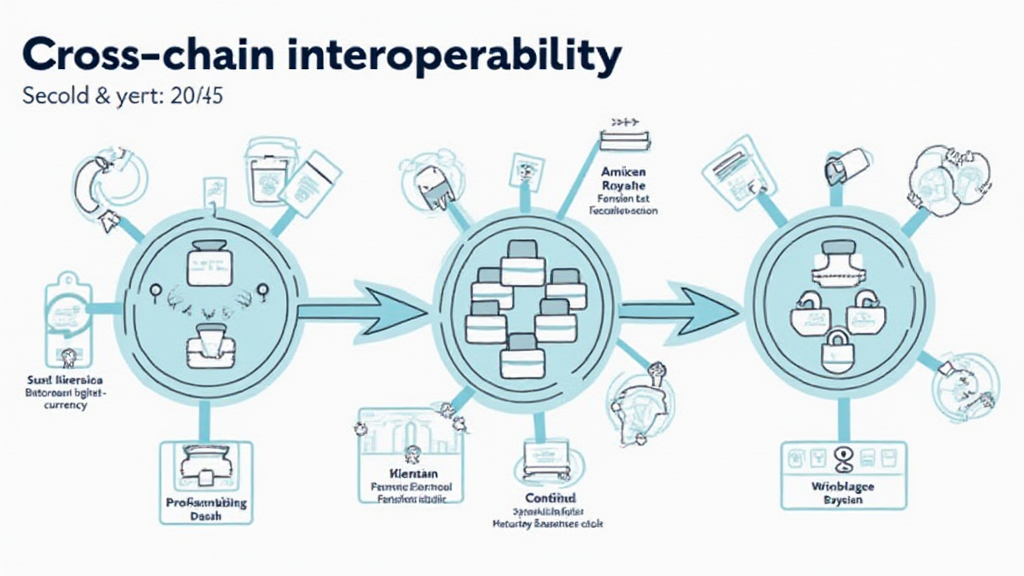

Understanding Cross-Chain Bridges

Think of cross-chain bridges like currency exchange booths at an airport. Just as you exchange your dollars for euros before visiting Europe, cross-chain bridges enable users to swap tokens across different blockchain networks. But with so many bridges vulnerable to hacks, it’s crucial to understand how to protect your assets.

Key Security Measures for 2025

In 2025, prioritizing security is more critical than ever. Reports from CoinGecko indicate that the PoS (Proof of Stake) mechanism can significantly reduce energy compared to traditional PoW (Proof of Work) systems. This reduction not only decreases operational costs but also aligns with growing environmental sustainability practices in crypto.

The Role of Zero-Knowledge Proofs

Imagine being able to prove you have enough money to buy groceries without revealing your entire bank balance. Zero-knowledge proofs work similarly by allowing one party to prove to another that they know a value without directly divulging it. This technology could bolster the security of cross-chain transactions throughout 2025, limiting potential data exposure.

Regulatory Trends in Singapore

As the DeFi landscape evolves, it’s vital for investors to stay informed about local regulation. In Singapore, the Monetary Authority is advancing its regulatory framework for DeFi, with a keen eye on ensuring security while fostering innovation. Understanding these regulations can prevent costly mistakes and enhance trust in digital assets.

In conclusion, as we approach 2025, a robust understanding of cross-chain interoperability, security practices, and local regulations will help safeguard your assets in an evolving marketplace. Don’t miss our downloadable toolkit for best practices on cross-chain security!

Download our comprehensive guide on cross-chain security

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authority (e.g., MAS, SEC) before making financial decisions. Tools like Ledger Nano X can reduce private key exposure risks by up to 70%.