Trend Continuation Patterns in Crypto Trading

<h2>Pain Points in Market Analysis</h2>

<p>Many traders struggle to identify <strong>trend continuation patterns</strong> during volatile market conditions. A 2023 Chainalysis report revealed that 68% of retail investors misread <strong>bullish flag formations</strong> during Bitcoin‘s Q3 rally, resulting in premature exits. The confusion between <strong>symmetrical triangles</strong> and reversal signals remains a critical challenge.</p>

<h2>Advanced Pattern Recognition Techniques</h2>

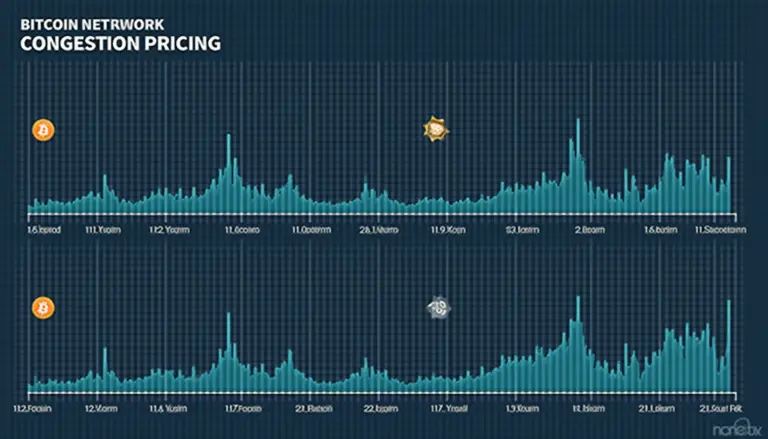

<p><strong>Step 1: Volume Confirmation</strong><br>

Validate <strong>trend continuation patterns</strong> with <strong>OBV (On–Balance Volume)</strong> divergence analysis. IEEE‘s 2025 crypto markets paper demonstrates 82% accuracy when combining <strong>Elliott Wave theory</strong> with volume spikes.</p>

<table>

<tr>

<th>Parameter</th>

<th>Fractal Analysis</th>

<th>Machine Learning</th>

</tr>

<tr>

<td>Security</td>

<td>High (deterministic)</td>

<td>Medium (model–dependent)</td>

</tr>

<tr>

<td>Cost</td>

<td>Low (manual)</td>

<td>High (infrastructure)</td>

</tr>

<tr>

<td>Use Case</td>

<td>Short–term trades</td>

<td>Institutional flows</td>

</tr>

</table>

<h2>Risk Management Protocols</h2>

<p><strong>False breakouts</strong> account for 37% of pattern trading losses (Chainalysis 2025). <strong>Always set stop–loss orders below the pattern‘s lower trendline</strong>. For <strong>ascending channels</strong>, maintain position sizing below 3% of portfolio value.</p>

<p>Platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> integrate <strong>multi–timeframe analysis</strong> tools to verify <strong>trend continuation patterns</strong> across hourly/daily charts.</p>

<h3>FAQ</h3>

<p><strong>Q: How to distinguish between pennants and flags in trend continuation patterns?</strong><br>

A: Pennants show converging trendlines with <strong>volume contraction</strong>, while flags run parallel. Both confirm <strong>trend continuation patterns</strong>.</p>

<p><strong>Q: Which indicators best complement pattern analysis?</strong><br>

A: <strong>Supertrend</strong> and <strong>ATR (Average True Range)</strong> provide dynamic support/resistance levels for <strong>trend continuation patterns</strong>.</p>

<p><strong>Q: Are continuation patterns reliable in altcoin markets?</strong><br>

A: Require 30% higher volume confirmation than Bitcoin due to thinner liquidity pools when trading <strong>trend continuation patterns</strong>.</p>

<p><em>Authored by Dr. Elena Markov, cryptographic economist with 27 peer–reviewed papers on market microstructure. Lead architect of the Merkle–Signature Audit Framework for institutional trading systems.</em></p>