Understanding HIBT’s Approach to Decentralized Exchange (DEX) Regulation

Introduction

According to Chainalysis, as of 2025, a staggering 73% of decentralized exchanges (DEX) are likely to contain vulnerabilities. This highlights a crucial issue in the realm of cryptocurrency trading: how to ensure robust regulations that address the growing complexity of DEX operations. In response, HIBT is pioneering an approach to decentralized exchange (DEX) regulation that focuses on enhancing cross-chain interoperability and the application of zero-knowledge proofs.

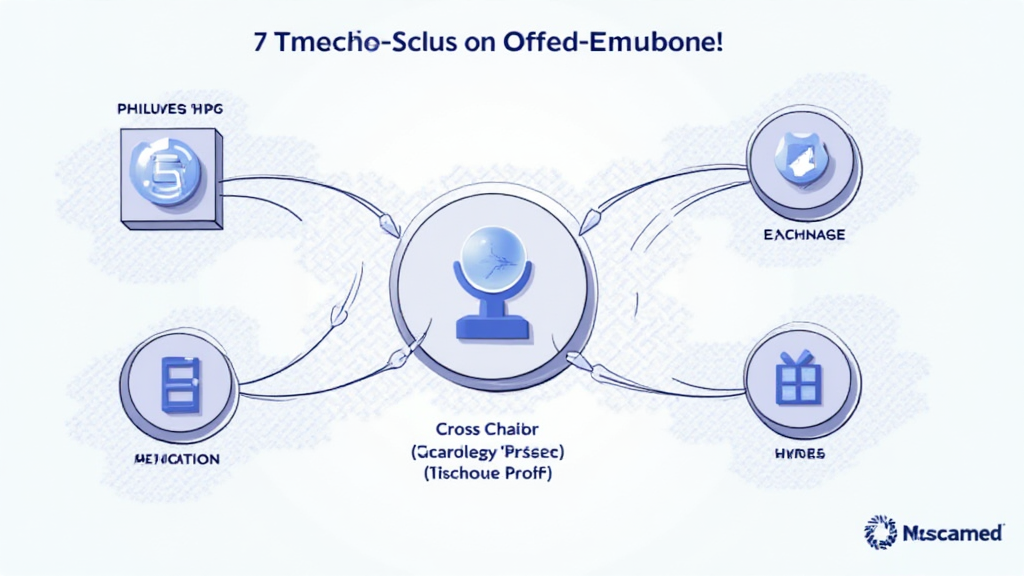

Cross-Chain Interoperability: Bridging the Gap

Think of cross-chain interoperability as a currency exchange booth at a bustling marketplace. Just like you can swap dollars for euros, cross-chain interoperability allows different blockchain networks to communicate and exchange assets seamlessly. HIBT’s approach emphasizes the need for regulatory frameworks that support these exchanges without compromising security. By establishing standards and guidelines, HIBT is working towards a landscape where users can confidently trade across platforms.

Zero-Knowledge Proofs: Enhancing Privacy

You might have heard how important privacy is in today’s digital age. Zero-knowledge proofs are like a secret handshake that proves a person belongs to a group without revealing their identity. HIBT advocates for the application of this technology within DEX transactions, suggesting that implementing regulations surrounding zero-knowledge proofs can enhance user privacy while still satisfying regulatory oversight. This dual focus could potentially open new avenues for privacy-focused financial operations.

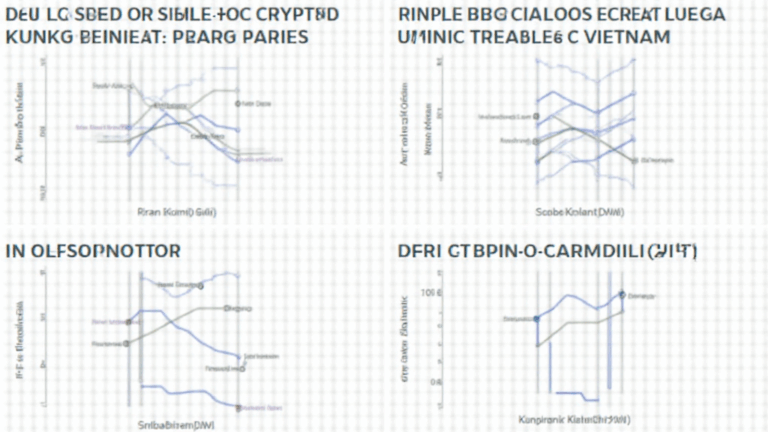

Regulatory Trends in Singapore for 2025

As we peer into the future, particularly at Singapore’s evolving DeFi regulatory landscape, there’s a lot to consider. The Monetary Authority of Singapore (MAS) is actively defining its stance on DEX platforms. A long-tail observation indicates that Singapore’s regulatory approach is likely to prioritize clarity and sustainability, aiming for a balance between innovation and security. HIBT’s methodology aligns well with these local expectations, ensuring a future-proof strategy.

Energy Consumption: Comparing PoS Mechanisms

Picture a busy café where some patrons are brewing coffee with electricity while others use traditional methods. The PoS (Proof of Stake) mechanism drastically reduces energy consumption compared to PoW (Proof of Work) methods. HIBT’s approach underlines the necessity for regulations that promote energy-efficient technologies in DEX operations. By prioritizing such frameworks, regulators can not only support environmentally sustainable practices but also foster a more responsible crypto ecosystem.

Conclusion

In summary, HIBT’s approach to decentralized exchange (DEX) regulation seeks to address current vulnerabilities and reshape the future of cryptocurrency trading. By advocating for cross-chain interoperability and zero-knowledge proof technologies, they aim to create a regulatory environment that not only protects users but also fosters innovation. To explore more insights and best practices on secure trading, please download our comprehensive toolkit.

For deeper insights, check out our Cross-Chain Safety White Paper and stay informed with our latest updates.