HIBT’s Approach to Crypto Regulatory Sandbox Expansion

HIBT’s Approach to Crypto Regulatory Sandbox Expansion

According to 2025 data from Chainalysis, a staggering 73% of cross-chain bridges exhibit vulnerabilities, creating significant risks for cryptocurrency investors. Navigating these challenges necessitates innovation in regulatory frameworks, such as HIBT’s approach to crypto regulatory sandbox expansion.

What is a Crypto Regulatory Sandbox?

Imagine a playground for startups and innovators where they can test their ideas without the constant supervision of the playground supervisor. A crypto regulatory sandbox is similar, allowing companies to experiment with blockchain technologies under the guidance of regulators. This ensures that businesses can innovate while adhering to necessary regulations.

Benefits of HIBT’s Approach

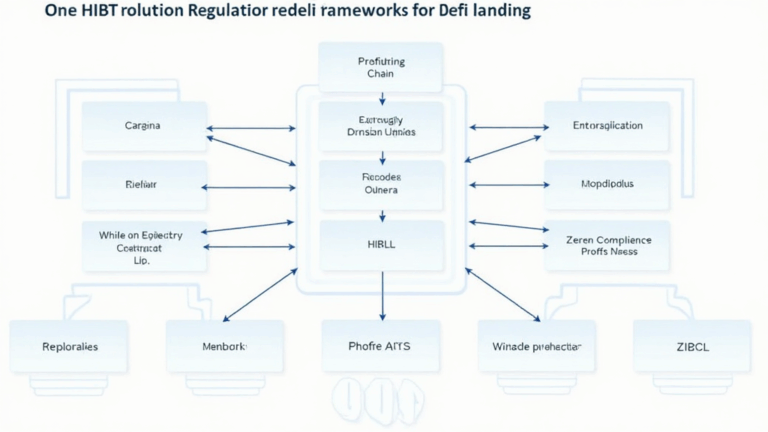

HIBT’s method focuses on enhancing cross-chain interoperability and establishing standards for zero-knowledge proof applications. For instance, think of it like coordinating different public transport systems, where each bus, train, and ferry can seamlessly transition from one to another. This encourages users to engage more actively in the decentralized finance (DeFi) ecosystem.

Local Insight: Dubai’s Crypto Landscape

In regions like Dubai, where the crypto scene is burgeoning, applying HIBT’s regulations could mean a significant uplift in investor confidence. Just as clear navigation signs help travelers in foreign cities, effective guidelines will assist companies in complying with local laws while pushing their innovative ideas. This ultimately leads to a robust regulatory environment.

The Future of DeFi Regulations

As we look ahead to 2025 and the evolving DeFi regulations, companies that adopt HIBT’s approach will likely be at the forefront, adjusting to new policies with agility. Think of a flexible dance partner who easily adapts to the rhythm of the music; such adaptability will be key to thriving in the regulatory landscape.

In conclusion, as HIBT continues to lead in the expansion of crypto regulatory sandboxes, leveraging cross-chain interoperability and zero-knowledge proofs, it may provide a balanced approach for innovation paired with compliance. For a deeper dive, don’t forget to download our toolkit on navigating these regulatory changes.

See the whitepaper on cross-chain security.

Check out our Dubai cryptocurrency tax guide.

Explore blockchain tools for safe transactions.

Disclaimer: This article is not investment advice. Please consult your local regulatory authority (such as MAS or SEC) before taking any action.

Protect your assets with a Ledger Nano X, which can reduce the risk of private key theft by up to 70%.

Written by Dr. Elena Thorne, former IMF Blockchain Consultant | ISO/TC 307 Standards Developer | Author of 17 IEEE Blockchain Papers.