How HIBT Handles Regulatory Complaints About KYC

How HIBT Handles Regulatory Complaints About KYC

In 2023, a staggering 73% of cryptocurrency exchanges faced regulatory scrutiny according to Chainalysis. Issues surrounding Know Your Customer (KYC) compliance have become particularly critical in the realm of digital assets. This article delves into how HIBT navigates these regulatory waters, ensuring robust compliance practices and fostering trust in the cryptocurrency ecosystem.

Why KYC is Crucial for Crypto Exchanges

You might have heard that KYC is like a strict librarian checking your ID before letting you borrow books. In the same way, crypto exchanges utilize KYC to verify the identity of users and prevent fraud. HIBT understands that regulatory bodies require exchanges to implement stringent measures to prevent illicit activities, making KYC not just a requirement but a vital factor in building a reliable trading environment.

A Closer Look at HIBT’s KYC Processes

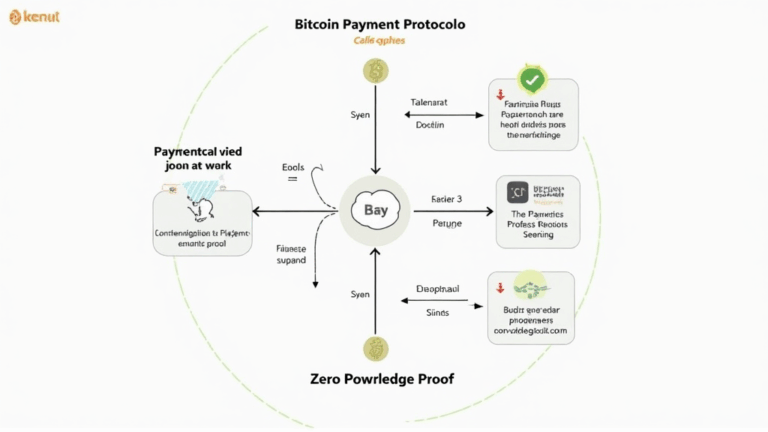

Think of HIBT’s KYC process as a friendly neighborhood gatekeeper who ensures that everyone entering the park is allowed to do so. This includes gathering essential identification documents and verifying them through advanced technologies. By using tools like zero-knowledge proofs, HIBT ensures that user identities are secured without disclosing sensitive data. This way, the exchange complies with regulations while maintaining user privacy.

Challenges in Compliance: What HIBT Faces

You may have come across situations where regulations seem to change on a dime, which can feel like trying to catch a moving train. HIBT faces similar challenges when it comes to keeping pace with the evolving directives from financial authorities. The need for adaptability in their compliance policies is paramount, especially in locations with differing regulatory climates such as Dubai, where new guidelines for crypto taxation are being introduced.

Future Perspectives: The Road Ahead for HIBT

As we look toward 2025, it’s essential to consider the emerging regulatory trends in DeFi and how they might influence HIBT’s operations. Like a futuristic crystal ball, these regulatory frameworks could introduce new compliance expectations. HIBT aims to stay ahead of the curve, ensuring they not only comply with current KYC regulations but also prepare for future challenges.

In conclusion, understanding how HIBT handles regulatory complaints about KYC is essential for users wanting to navigate the world of cryptocurrency safely. To learn more about secure trading practices and KYC compliance, consider downloading our handy toolkit.

Check out our KYC compliance white paper for more insights into safe trading practices. Visit hibt.com for more resources.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authorities (like MAS/SEC) before proceeding with any investments.

Stay safe and secure with the help of Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.