How HIBT Handles Regulatory Issues with Stablecoin Issuers

How HIBT Handles Regulatory Issues with Stablecoin Issuers

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are vulnerable to regulatory and security risks. This raises critical concerns for the future of stablecoin platforms looking to stay compliant and secure. So, how does HIBT address regulatory challenges faced by stablecoin issuers? Let’s break it down.

Understanding Regulatory Compliance

Regulatory compliance might sound complex, but think of it as following a recipe in a kitchen. Just like you need to have all ingredients in the right proportions, stablecoin issuers must adhere to rules set by financial authorities. HIBT ensures that their issuers meet these standards, much like checking off ingredients before they hit the oven.

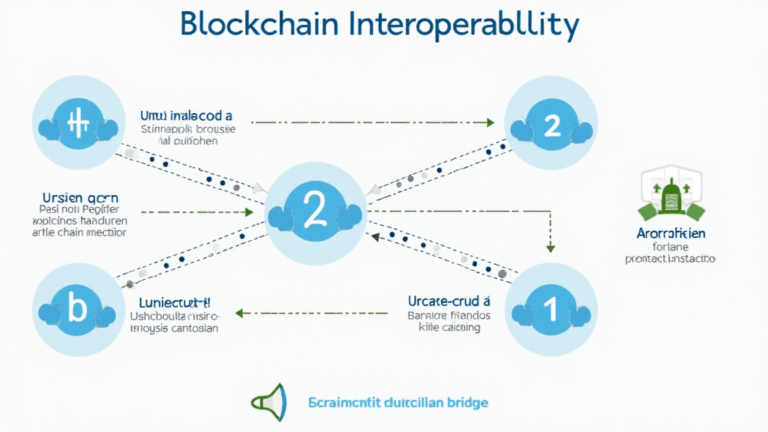

Cross-Chain Interoperability Explained

When we talk about cross-chain interoperability, imagine a currency exchange booth at an airport. Passengers exchange their currencies to travel abroad, and similarly, HIBT allows different blockchains to interact smoothly. This not only enhances efficiency but also aligns with regulatory guidelines that necessitate seamless operations across jurisdictions.

The Role of Zero-Knowledge Proofs

You might have heard about zero-knowledge proofs (ZKPs), but let’s simplify it. Imagine you want to prove to a friend that you have money without showing them your bank statement. ZKPs allow network participants to verify information without exposing sensitive data. HIBT uses ZKPs to maintain privacy and compliance, accommodating regulations while keeping user information confidential.

Future Trends in Stablecoin Regulation

As we look ahead to 2025, the regulatory landscape for stablecoins in regions such as Dubai is evolving. Just as fashion trends change seasonally, so do regulations. Staying informed about these trends is essential for stablecoin issuers, and HIBT is committed to providing updates and guidance to navigate this dynamic scenario.

In conclusion, HIBT effectively handles regulatory issues with stablecoin issuers by prioritizing compliance, enhancing cross-chain interoperability, utilizing zero-knowledge proofs, and staying ahead of future regulatory trends. For more insights, check out our complete regulatory guide and learn how to mitigate risks.

Download our comprehensive toolkit that includes essential practices and tools like Ledger Nano X to reduce the risk of private key exposure by 70%! Remember, this article does not constitute investment advice. Always consult your local regulatory bodies like MAS or SEC before making any financial decisions.