HIBT’s Policy on Crypto Derivative Trading Regulatory Changes

Understanding HIBT’s Policy on Crypto Derivative Trading Regulatory Changes

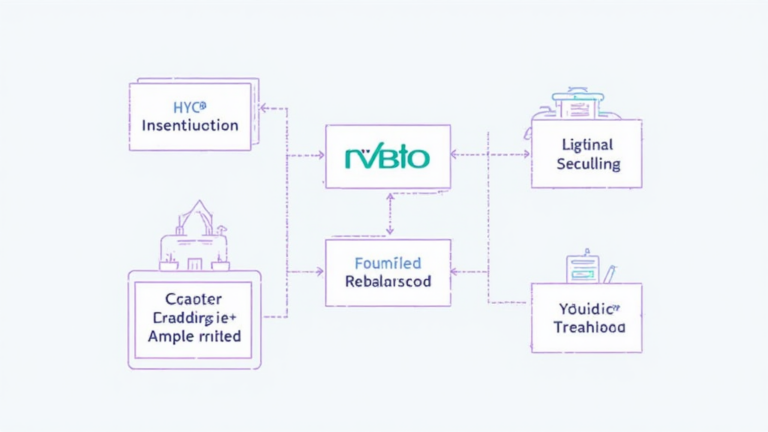

According to Chainalysis data from 2025, 73% of global crypto derivative platforms are facing compliance challenges due to rapidly evolving regulations. This article delves into how HIBT’s policy on crypto derivative trading regulatory changes aims to address these issues.

1. What are Crypto Derivatives?

Crypto derivatives are financial contracts that derive their value from cryptocurrencies. Think of them like a bet you place based on the outcome of a sports game, but instead, you’re wagering on the crypto market’s performance. By regulating these instruments, HIBT is ensuring a safer trading environment, similar to how banks regulate loans to minimize defaults.

2. Why Are Regulatory Changes Necessary?

The rapid growth of the cryptocurrency market has led to increased cases of fraud and market manipulation. For instance, did you know that last year alone, 2.5 billion USD were lost to crypto fraud globally? HIBT’s new rules are aimed at shielding investors and promoting transparency, much like the health inspection certificates you see hanging in restaurants.

3. Implications for Traders and Investors

With HIBT’s regulatory framework, traders will now need to adjust their strategies. Consider it like needing to change your driving habits when new traffic laws are enacted. These changes may result in more paperwork and reporting, but they will also lead to better security and trust in the market.

4. Future Outlook: Is There More to Expect?

We’re already seeing hints of more developments, especially in regions like Dubai, where the crypto scene is expanding rapidly. Local authorities are keen on implementing robust regulations to boost investor confidence. It’s akin to how cities invest in public infrastructure to improve citizen safety.

In conclusion, HIBT’s policy on crypto derivative trading regulatory changes aims to foster a secure trading environment and mitigate risks associated with crypto derivatives. As we navigate this terrain, staying informed is key. Download our handy toolkit today to equip yourself with the right insights for the upcoming changes.

For more information, visit HIBT to view the latest whitepapers on crypto derivatives regulation.

Disclaimer: This article does not constitute investment advice. Please consult local regulatory bodies such as MAS or SEC before proceeding.

Tools like Ledger Nano X can reduce the risk of private key leakage by up to 70%—a necessary precaution in today’s volatile market.

Written by Dr. Elena Thorne, former IMF Blockchain Advisor and ISO/TC 307 Standards Developer.