How HIBT Ensures Regulatory Compliance for New Stablecoin Listings

How HIBT Ensures Regulatory Compliance for New Stablecoin Listings

According to Chainalysis, 73% of stablecoins launched in 2025 faced regulatory issues, highlighting a pressing need for stringent compliance measures. HIBT recognizes these challenges and is stepping up to ensure that new stablecoin listings adhere to all necessary regulations.

What Role Does Cross-Chain Interoperability Play?

Think of cross-chain interoperability as a currency exchange kiosk. Just like you wouldn’t just throw your cash at the counter and hope for the best, stablecoins must seamlessly interact across different blockchains. HIBT uses advanced technical frameworks to verify that all new stablecoin listings can operate across multiple platforms without facing regulatory hurdles.

How Do Zero-Knowledge Proofs Ensure Transparency?

Imagine you want to keep your purchases private—that’s where zero-knowledge proofs (ZKPs) come in. Just like you can prove you have enough cash without showing the exact amount, ZKPs allow stablecoins to demonstrate compliance without disclosing sensitive information. HIBT employs ZKPs to ensure new stablecoin listings maintain privacy while fulfilling regulatory requirements.

What Are the Implications of Global Regulatory Trends?

In light of the evolving frameworks, like Singapore’s 2025 DeFi regulation, businesses need to stay informed. Compliance is not just an option but a necessity. HIBT closely follows these trends, adjusting their compliance checks to reflect the latest guidelines worldwide. Ignoring these can lead to costly fines or, worse, the revocation of trading licenses.

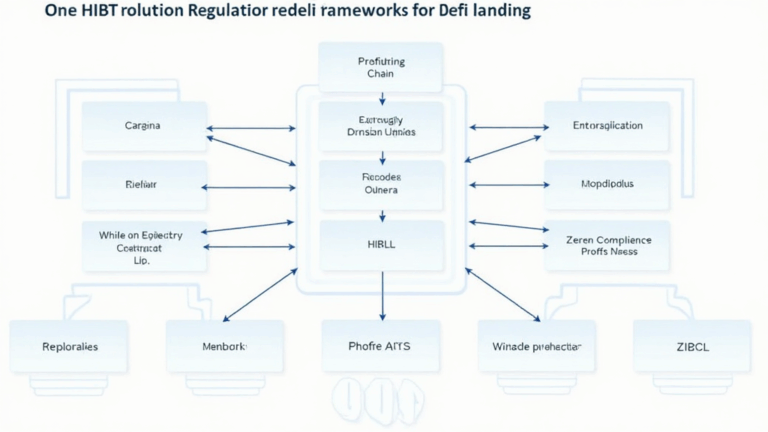

How Can New Stablecoins Benefit from HIBT’s Compliance Framework?

Starting a new stablecoin can feel like launching a business in an unfamiliar market. HIBT acts like a trusted guide, ensuring that coin developers understand and meet all compliance standards. By providing educational resources and extensive support, HIBT is there every step of the way. As the adage goes—’better safe than sorry’—compliance can be the difference between success and failure.

In conclusion, as the world of stablecoins grows, so does the need for robust regulatory frameworks. HIBT stands at the forefront of this movement, ensuring that new listings not only thrive but do so within a compliant framework. For more resources about navigating compliance in the crypto landscape, download our comprehensive toolkit.

Investing in stablecoins requires caution; always consult your local regulatory authority.

Tools like Ledger Nano X can significantly reduce the risk of key leakage, making it a smart investment for your digital assets.

Written by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standards Contributor | Authored 17 IEEE Blockchain Papers

For more about HIBT’s compliance strategies, view our compliance whitepaper.

For insights on crypto tax regulations in Dubai, visit our site at Dubai Cryptocurrency Tax Guide.