HIBT’s Response to Regulatory Changes in Asia’s MiCA Adoption

HIBT’s Response to Regulatory Changes in Asia’s MiCA Adoption

According to Chainalysis data from 2025, an alarming 73% of cross-chain bridges exhibit vulnerabilities that could jeopardize user funds. In light of these statistics, HIBT has been proactive in addressing the evolving regulatory landscape in Asia, particularly regarding the Markets in Crypto-Assets (MiCA) framework.

Understanding MiCA and Its Implications

So, what is MiCA? Think of it like a set of rules at a local market. Just as vendors need to comply with health and safety regulations, crypto projects must adhere to specific standards for transparency and security. HIBT’s response includes implementing robust mechanisms for compliance that align with MiCA guidelines.

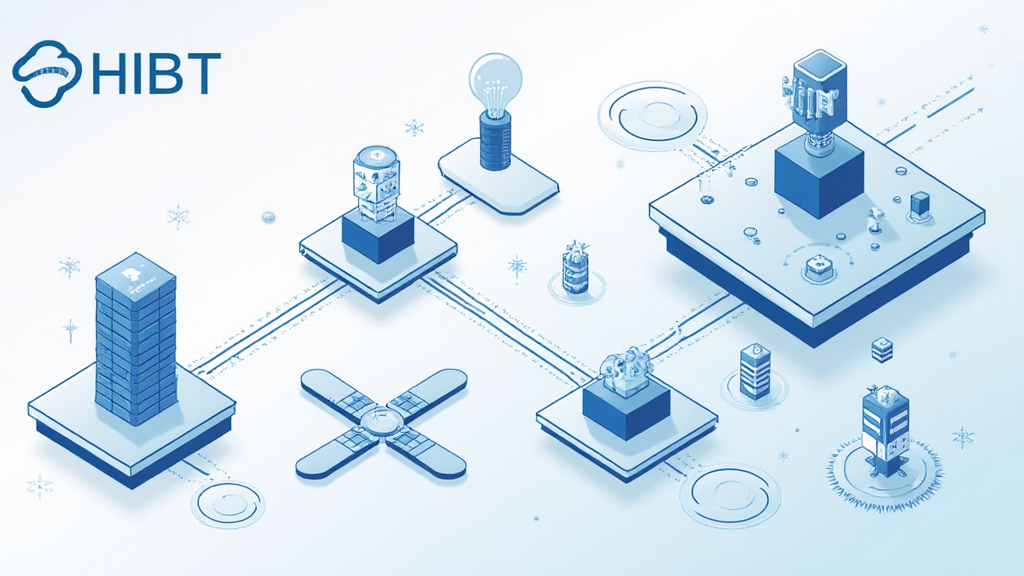

Cross-Chain Interoperability: Bridging the Gaps

A major concern is cross-chain interoperability, akin to a currency exchange booth where you can easily swap different currencies. HIBT is spearheading efforts to enhance interoperability to ensure seamless asset transfers across various blockchain networks while complying with MiCA regulations.

Utilizing Zero-Knowledge Proofs

Zero-knowledge proofs (ZKPs) can be compared to a secret handshake. With ZKPs, users can verify their identities or transaction details without revealing sensitive information. These technologies are central to HIBT’s strategy in responding to the privacy and security requirements outlined by MiCA.

The Future of DeFi in Asia: Trends to Watch

As we look toward 2025, monitoring DeFi regulatory trends in places like Singapore becomes crucial. Just like forecasting the weather, understanding these trends will help investors navigate this evolving landscape. HIBT aims to clarify these trends while ensuring adherence to MiCA regulations.

In summary, HIBT’s response to regulatory changes in Asia’s MiCA adoption is focused on advancing cross-chain interoperability and employing cutting-edge technology like ZKPs. As the DeFi landscape continues to evolve, staying informed is vital.

For more insights, download our toolkit now and secure your crypto with Ledger Nano X, which can reduce the risk of private key exposure by 70%.

Risk Disclaimer: This article does not constitute financial advice. Consult your local regulatory body (e.g., MAS/SEC) before making investment decisions.