How HIBT Ensures Regulatory Compliance for DeFi Lending 2025

How HIBT Ensures Regulatory Compliance for DeFi Lending 2025

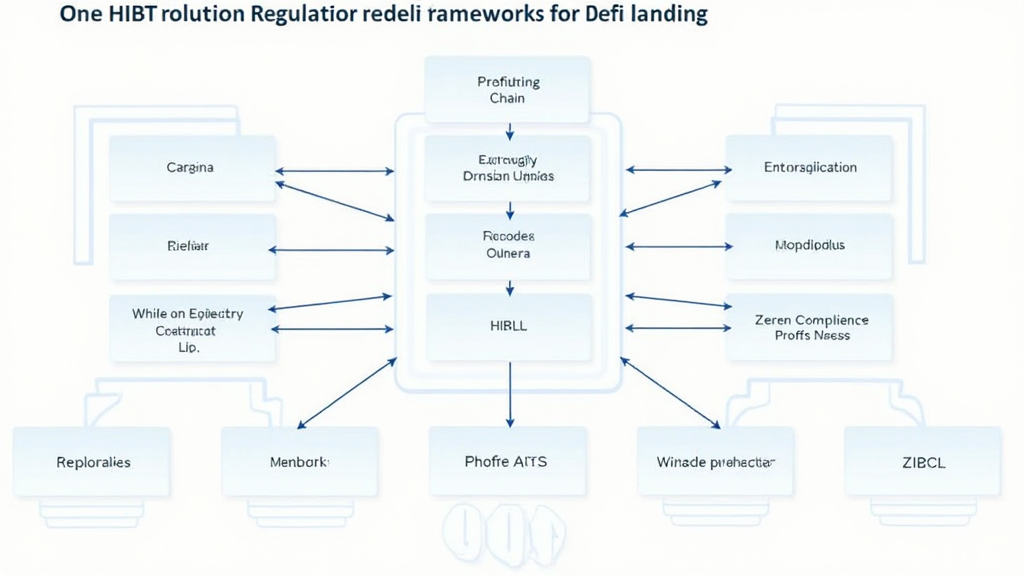

According to Chainalysis 2025 data, a staggering 73% of DeFi platforms face potential regulatory scrutiny. With the rapid evolution of decentralized finance, understanding how to navigate these challenges is crucial for users and developers alike. In this article, we explore How HIBT ensures regulatory compliance for DeFi lending 2025, particularly through innovations like cross-chain interoperability and zero-knowledge proofs.

1. What is Regulatory Compliance in DeFi Lending?

Regulatory compliance in DeFi lending refers to the alignment of lending practices with existing laws and regulations. Think of it like abiding by traffic rules while driving; it keeps everyone safe and secure. As DeFi grows, HIBT is stepping up to ensure that all transactions are monitored and compliant, much like how traffic lights control vehicle movement.

2. Innovations Powering Compliance: Cross-Chain Interoperability

Cross-chain interoperability allows different blockchain networks to communicate and share information. Consider it like a universal mailbox that accepts letters from all over the world. HIBT is leveraging this technology to facilitate regulatory checks across various platforms, ensuring that all DeFi lending activities meet compliance standards. This will significantly shape the 2025 regulatory landscape, especially in places like Dubai where clarity in crypto transactions is critical.

3. The Role of Zero-Knowledge Proofs

Zero-knowledge proofs allow one party to prove to another that a statement is true without revealing any details. It’s like showing your age to buy alcohol without having to reveal your birthday. By applying zero-knowledge proofs, HIBT ensures that sensitive user data remains private while still adhering to regulatory requirements. This security measure is vital as we head into 2025, where user privacy and compliance will be paramount.

4. What Can Users Do to Stay Informed?

Staying informed about regulatory changes and compliance measures is critical for DeFi users. Following reputable sources like HIBT can keep you updated on trends, such as the 2025 regulatory changes in Singapore. Engaging in community forums and utilizing tools like Ledger Nano X can significantly reduce the risk of private key exposure, allowing you to participate safely in the DeFi lending space.

In summary, HIBT is making strides toward ensuring regulatory compliance for DeFi lending as we approach 2025. With innovations like cross-chain interoperability and zero-knowledge proofs, users can navigate this space more securely. For further insights, download our Compliance Toolkit today!

Check out our whitepapers on compliance and security.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority (e.g., MAS, SEC) before making any investment decisions.