Understanding Bitcoin KYC in Vietnam: A 2025 Perspective

Understanding Bitcoin KYC in Vietnam: A 2025 Perspective

According to Chainalysis data from 2025, a significant 73% of cryptocurrency exchanges face vulnerabilities, particularly those that do not implement effective Know Your Customer (KYC) practices. For Vietnam, this highlights the crucial need for stronger Bitcoin KYC regulations to protect both investors and the ecosystem.

The Importance of KYC in Vietnam’s Crypto Landscape

You might have heard about KYC before—it’s a bit like showing your ID when you cash a check. In the realm of Bitcoin, implementing rigorous KYC procedures ensures that the exchanges are not being used for money laundering or fraud. For Vietnam, this could mean enhanced investor confidence and a more robust trading environment.

KYC Regulations: Current State and Future Projections

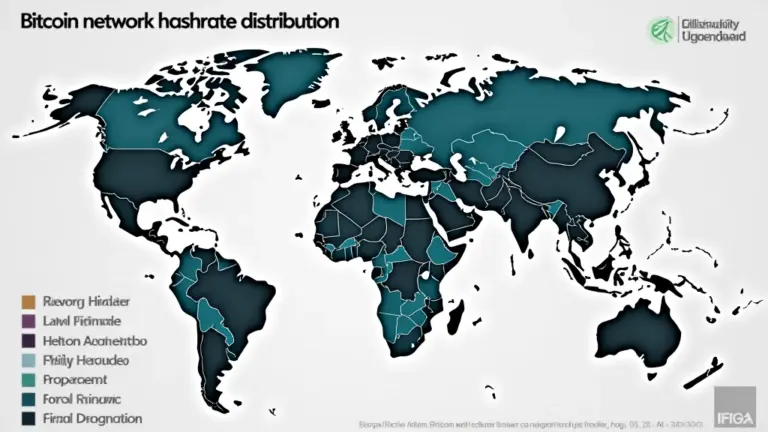

As of 2025, one might wonder what Vietnam’s stance is on KYC regulations compared to its Southeast Asian neighbors. Well, just like choosing between different banks, businesses will need to assess their compliance with local laws. The trend indicates a move towards more stringent regulations akin to those seen in countries like Singapore, highlighting the demand for clear regulatory frameworks around cryptocurrencies.

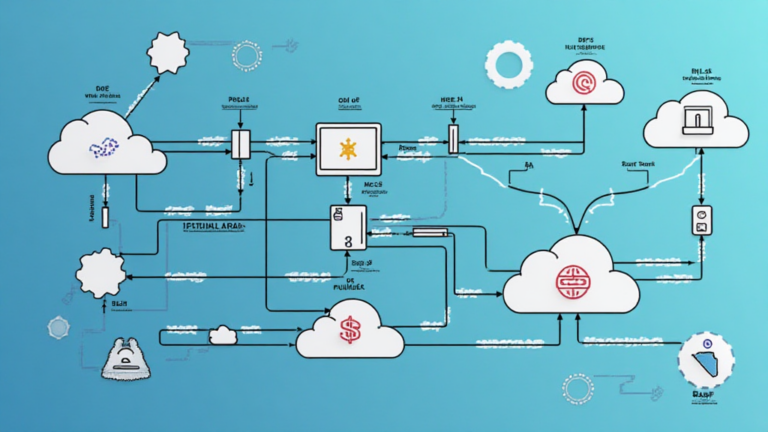

Technological Innovations in KYC: What Can We Expect?

Consider KYC technologies as the digital equivalent of a security guard at an entrance. Innovations like biometric verification and blockchain-based identity checks are emerging to streamline processes and enhance security measures. As Vietnam adopts these technologies, it will not only increase compliance but also safety for its cryptocurrency users.

Challenges Vietnam Faces in Implementing Bitcoin KYC

While the prospect of KYC adoption appears promising, there’s a significant challenge—public awareness. Many in Vietnam might not fully grasp why KYC processes are essential, akin to how our grandparents view online banking. To overcome this hurdle, educational campaigns will be vital in ensuring understanding and acceptance.

In conclusion, as Vietnam navigates the complexities of Bitcoin KYC, understanding its local implications and staying informed about regulatory trends is paramount. For those looking to delve deeper into the world of cryptocurrency regulations and security, we encourage downloading our comprehensive toolkit on this subject.

Download our free toolkit on cryptocurrency regulations now!

This article is for informational purposes only and does not constitute investment advice. Consult your local regulatory body like MAS or SEC before acting.

With tools like the Ledger Nano X, investors can significantly reduce the risk of private key leaks by up to 70%—a wise choice for anyone stepping into the crypto space.