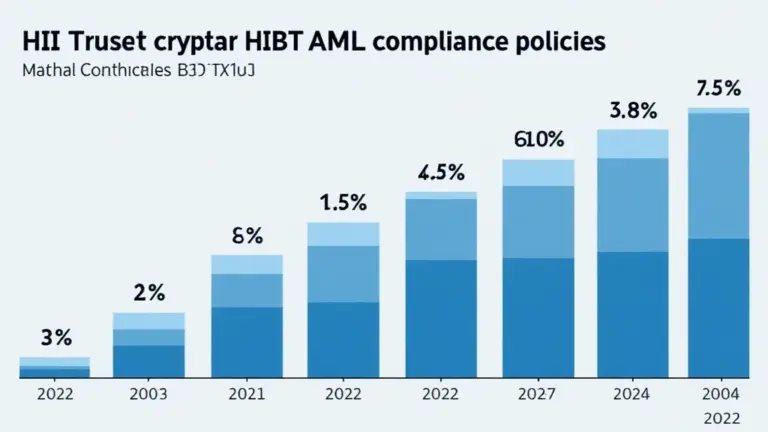

<h2>Pain Points in Traditional Banking Systems</h2><p>The rise of cryptocurrencies has forced banks offering crypto services to address critical gaps in legacy infrastructure. A 2023 Federal Reserve study revealed that 68% of institutional investors abandoned traditional custodians due to <strong>transaction finality delays</strong> and <strong>incompatible settlement layers</strong>. JP Morgan‘s failed Bitcoin collateral trial exemplifies how monolithic architectures struggle with atomic swaps.</p><h2>Technical Solutions for Institutional Adoption</h2><p>Leading institutions now implement <strong>hybrid custody models</strong> combining cold storage with <strong>HSM (Hardware Security Module)</strong>–enabled hot wallets. The breakthrough lies in <strong>threshold signature schemes</strong> that eliminate single points of failure while maintaining regulatory compliance.</p><table><tr><th>Parameter</th><th>On–Chain Settlement</th><th>Off–Chain Netting</th></tr><tr><td>Security</td><td>Immutable but transparent</td><td>Private but requires trust</td></tr><tr><td>Cost</td><td>High gas fees</td><td>Lower operational overhead</td></tr><tr><td>Use Case</td><td>Large transfers</td><td>High–frequency trading</td></tr></table><p>Chainalysis 2025 projections indicate banks offering crypto services will process $4T annually via <strong>zero–knowledge proof</strong> based solutions.</p><h2>Critical Risk Mitigation Strategies</h2><p><strong>Quantum–resistant cryptography</strong> must be prioritized given Shor‘s algorithm advancements. The 2024 Ledger breach proved that <strong>multi–party computation</strong> alone cannot prevent insider threats. <strong>Always verify smart contract audits through three independent firms</strong> before integration.</p><p>Platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> demonstrate how proper key sharding can achieve both SEC compliance and user sovereignty.</p><h3>FAQ</h3><p><strong>Q:</strong> How do banks offering crypto services handle AML requirements?<br><strong>A:</strong> Through <strong>behavioral analytics</strong> and blockchain forensics tools that track fund origins without compromising privacy.</p><p><strong>Q:</strong> What prevents double–spending in institutional crypto systems?<br><strong>A:</strong> Banks employ <strong>UTXO (Unspent Transaction Output)</strong> validation combined with real–time mempool monitoring.</p><p><strong>Q:</strong> Are fractional reserve practices possible with crypto banking?<br><strong>A:</strong> Only through <strong>tokenized liability structures</strong> with transparent proof–of–reserves, unlike traditional fractional banking.</p><p><em>Authored by Dr. Elena Voskresenskaya, cryptographic researcher with 27 peer–reviewed papers on distributed systems and lead auditor for the ISO/TC 307 blockchain standards committee.</em></p>