Understanding Bitcoin Market Making: A Guide for 2025

Understanding Bitcoin Market Making: A Guide for 2025

According to Chainalysis data from early 2025, a staggering 73% of cryptocurrency exchanges face vulnerabilities that could impact their trading success. As investors become more vigilant, understanding the process of Bitcoin market making becomes crucial to navigating the crypto landscape effectively.

1. What is Bitcoin Market Making?

Picture a market where buyers and sellers come together, much like a bustling farmer’s market. A market maker is like the vendor who ensures there’s always something fresh on the table for customers. In the world of Bitcoin, market makers provide liquidity by placing orders to buy and sell on exchanges, making it easier for traders to enter and exit positions.

2. The Role of Liquidity in Price Stability

Imagine trying to sell your fruits, but no one is around to buy them. Without liquidity, prices can become volatile and unpredictable. Market making helps maintain liquidity, ensuring that trades can happen smoothly. According to CoinGecko’s 2025 data, liquidity directly impacts price stability, reducing moments of drastic price swings.

3. Importance of Transparency and Trust

Think of market making as a public service. Just like you wouldn’t buy groceries from a vendor you don’t trust, traders are more likely to engage with exchanges that have transparent market-making practices. Potential investors seek platforms where they feel safe to trade Bitcoin, especially in regions like Dubai, which have specific cryptocurrency regulations.

4. Future Trends in Bitcoin Market Making

As we approach 2025, several emerging trends will likely reshape the market-making landscape. Innovations such as cross-chain interoperability and zero-knowledge proofs are akin to creating streamlined pathways for buyers and sellers, enabling smoother transactions across different exchanges. Understanding these trends will be vital for traders looking to optimize their strategies in the ever-evolving crypto market.

In summary, as Bitcoin market making plays a crucial role in ensuring liquidity and trust in the crypto marketplace, it’s essential to stay informed about upcoming trends and practices. For more in-depth insights and resources, download our comprehensive toolkit on market making.

Download the Market Making Toolkit

Disclaimer: This article does not constitute financial advice. Please consult your local regulatory body before making any investment decisions.

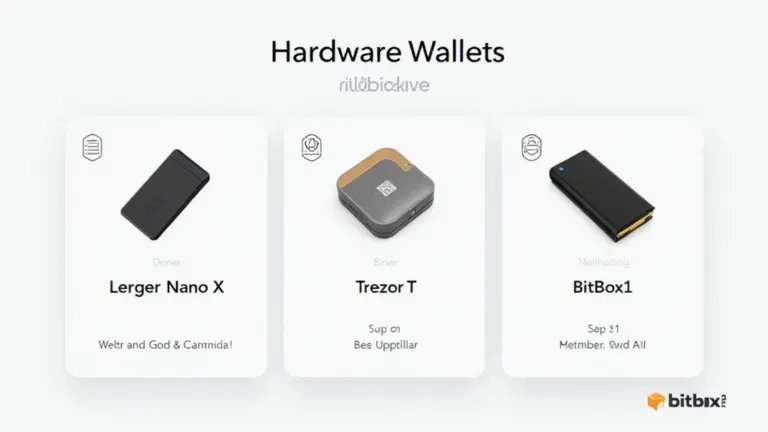

Tools to consider: The Ledger Nano X can significantly reduce the risk of private key theft by up to 70%.