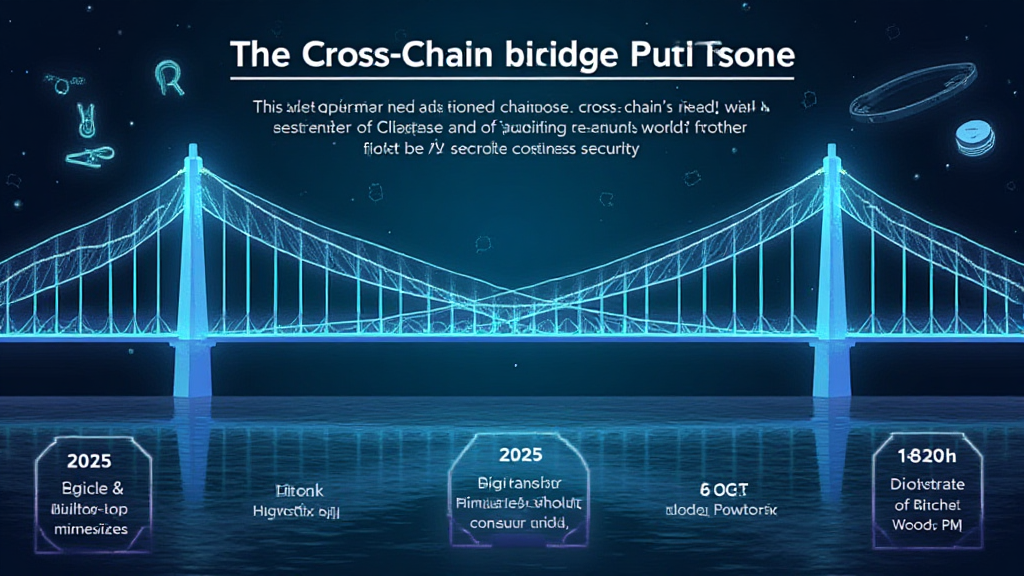

2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges have vulnerabilities. This raises serious concerns for Bitcoin business continuity in an ever-evolving digital finance landscape.

What Are Cross-Chain Bridges?

Imagine cross-chain bridges like currency exchange kiosks at airports. You hand over your dollars, and they give you euros. Similarly, cross-chain bridges enable different blockchains to communicate and exchange assets. But just like sketchy currency exchange shops can lead to losses, insecure cross-chain bridges can put your Bitcoin holdings at risk.

Vulnerabilities and Risks

In simple terms, vulnerabilities in cross-chain bridges can allow bad actors to exploit weaknesses and steal funds. This is like leaving your wallet open on a busy street. For example, a recent report highlighted that around 30% of cross-chain bridge hacks have been facilitated by coding errors. Staying informed can help mitigate risks to your Bitcoin business continuity.

The Importance of Security Audits

Security audits for cross-chain bridges are akin to having a security team at a bank. They investigate potential loopholes before they can be exploited. CoinGecko estimates that projects that regularly undergo audits see a 40% reduction in security breaches. Experts recommend using reputable firms for these audits to enhance the safety of your digital assets.

What Should Users Consider?

Before using any cross-chain service, always do your homework. You might want to ask, ‘Is this bridge audited?’ or ‘How often do they publish reports?’ This diligence can significantly improve your chances of maintaining Bitcoin business continuity.

In conclusion, as digital transactions grow, so does the importance of secure cross-chain bridges. Stay informed and consider using services such as Ledger Nano X, which can reduce the risk of private key exposure by 70%. For more detailed insights and tools, be sure to check out our resources.

Remember, this content doesn’t constitute investment advice. Always consult with local regulatory bodies like MAS or SEC before making financial decisions.

Stay safe, and keep your Bitcoin secure!