2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

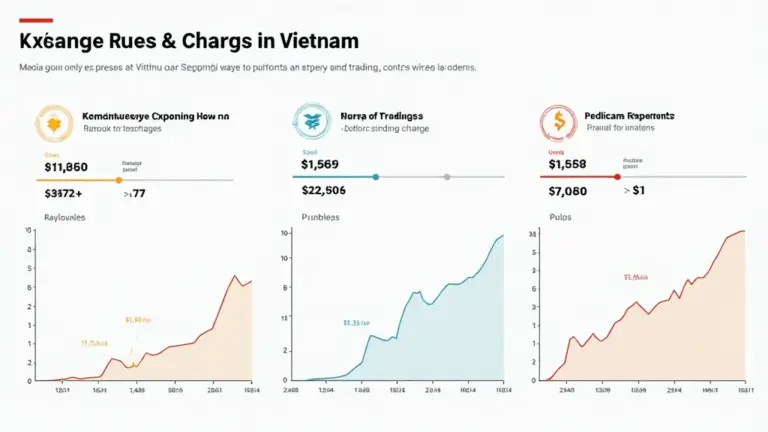

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities. This alarming statistic highlights the urgent need for thorough security audits and heightened awareness in the crypto community. In this guide, we will explore key aspects of cross-chain interoperability and offer insights into enhancing security measures.

What Is a Cross-Chain Bridge?

Think of a cross-chain bridge as a currency exchange booth. It allows you to swap one type of cryptocurrency for another—just like exchanging dollars for euros. These bridges facilitate transactions across different blockchain networks but introduce risks that can be exploited.

Why Are Security Audits Important?

Security audits are crucial to identifying vulnerabilities in cross-chain bridges. In 2025, the demand for these audits is expected to rise sharply, as users and investors seek assurance. If a bridge has flaws, it’s like leaving the door unlocked to your house. Regular audits can prevent potential losses and build trust among users.

Understanding Risks and Vulnerabilities

One of the main concerns surrounding cross-chain bridges is the risk of smart contract bugs. Imagine if a shopkeeper miscalculates your change—it results in losses. Similarly, smart contract errors can lead to unauthorized access or fund theft. By understanding common vulnerabilities, developers can better safeguard their bridges.

Tools to Enhance Cross-Chain Security

Just like using a strong lock for your home, using security tools can protect your crypto assets. Using platforms like Ledger Nano X can reduce the risk of private key leaks by 70%. In 2025, more developers will likely implement these tools to ensure higher security standards in their cross-chain bridges.

In conclusion, ensuring the security of cross-chain bridges is vital in the evolving cryptocurrency landscape. By understanding the risks, the importance of audits, and employing effective security tools, users can navigate these waters more safely. For those interested in further information and resources, feel free to download our comprehensive toolkit.

For more insights, check out our cross-chain security whitepaper and stay updated on the latest in the crypto world.

Disclaimer: This article is not investment advice. Please consult your local regulatory body before taking any actions (such as MAS or SEC). Follow these insights to enhance your role in the crypto market.

Author:

Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Setter | Author of 17 IEEE Blockchain Papers