2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, an astonishing 73% of cross-chain bridges exhibit vulnerabilities that could lead to significant financial losses. As the world of cryptocurrency continues to grow, the need for robust security measures has never been more critical. In this article, we will delve into how Web3 semantic web technologies, such as cross-chain interoperability and zero-knowledge proof applications, can help mitigate these risks.

Understanding Cross-Chain Bridges

To put it simply, cross-chain bridges are like currency exchange booths at an airport. Just as you exchange your money for local currency to shop in a new country, cross-chain bridges facilitate the transfer of assets between different blockchain networks. However, just like some of those booths may rip you off, some bridges can be vulnerable to security attacks. Understanding how these systems work can help you navigate the crypto world more safely.

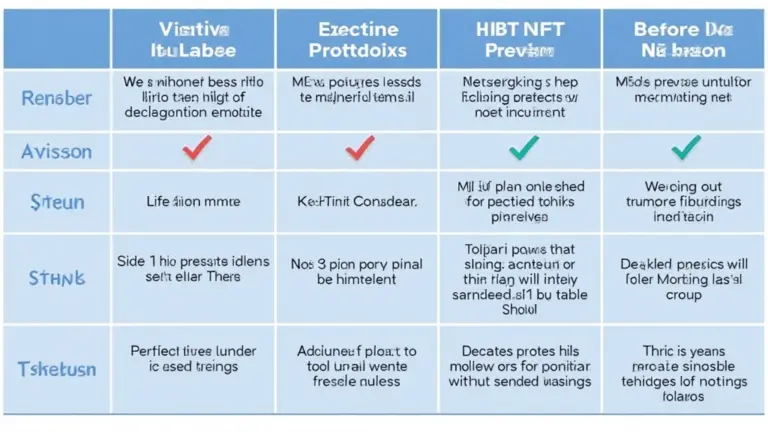

Identifying Vulnerabilities in Current Systems

Research indicates that many existing cross-chain bridges lack proper security measures. With Chainalysis highlighting a 73% vulnerability rate, it’s vital for users to understand the risks involved. Think of it as driving a car without a seatbelt; it may get you to your destination, but if you’re in an accident, you’re at a higher risk of injury. Identifying these vulnerabilities helps ensure safer transactions in the decentralized finance (DeFi) ecosystem.

The Role of Zero-Knowledge Proofs

Zero-knowledge proofs are like asking someone to prove they have a ticket to a concert without showing the actual ticket. This technology allows for the verification of information without revealing the details behind it. For cross-chain bridges, this means users can transact securely, proving ownership of assets without exposing sensitive information. By leveraging these proofs, we can build a more secure network, reducing the possibility of fraud.

Future Trends in DeFi Regulation

Looking ahead, the regulatory landscape for DeFi in regions like Singapore is set to evolve significantly by 2025. As governments seek to regulate these new technologies, understanding the implications is crucial. Imagine navigating a new city without a map; having clarity on regulations can guide users safely through the complex world of digital assets.

In conclusion, as the landscape of cryptocurrency evolves, utilizing Web3 semantic web technologies such as cross-chain interoperability and zero-knowledge proof applications can significantly enhance security in cross-chain transactions. To further explore this subject and download our comprehensive toolkit on enhancing cross-chain security, visit our resource page.