2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges still have vulnerabilities. These bridges are critical for Web3 edge computing, enabling different blockchain ecosystems to interact. However, with increasing opportunities, there are more risks involved. Here’s what you need to know to navigate this landscape safely.

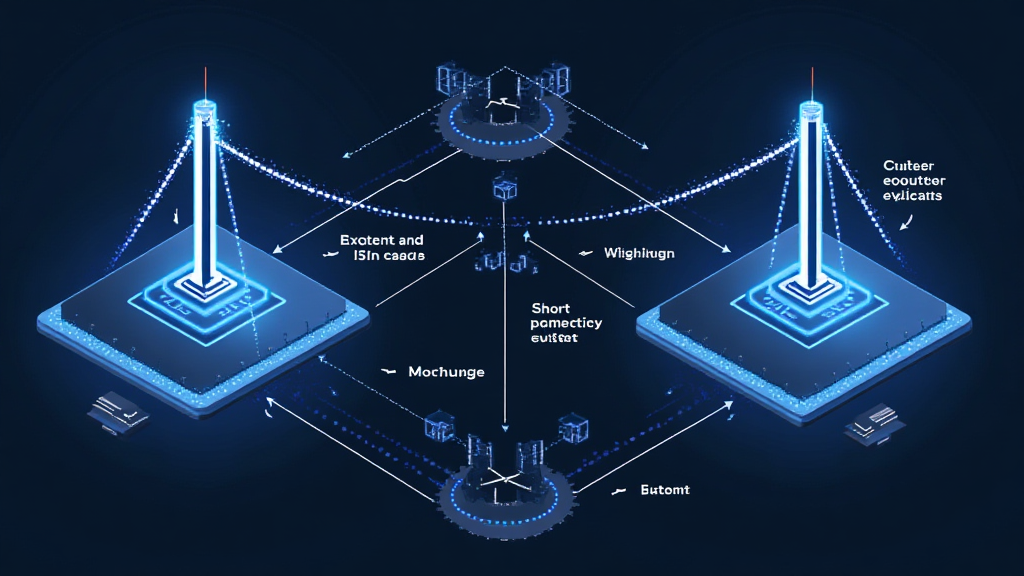

Understanding Cross-Chain Bridges

Think of cross-chain bridges like a currency exchange booth at the airport. When you travel, you need to convert your home currency into the local currency to make purchases. Similarly, cross-chain bridges allow users to exchange assets between different blockchains, such as Ethereum and Binance Smart Chain. As crypto transactions grow, ensuring these bridges are secure is paramount.

Risks and Vulnerabilities in 2025

While many users rely on cross-chain bridges, a significant number still lack adequate security measures, much like how some airports might have poorly trained staff at currency exchange booths. In 2025, hacks targeting cross-chain bridges are on the rise, with over $1 billion lost to vulnerabilities, as CoinGecko reports. The implications for DeFi are huge; thus, knowing the risks is crucial.

Solutions for Secure Cross-Chain Interactions

So what can you do? First, ensure you use reputable bridges with a good track record. Additionally, employing zero-knowledge proof applications can enhance privacy and security in transactions. To think about it simply, it’s like using a safe deposit box at a bank rather than carrying cash openly. Consider investing in smart contracts that undergo regular audits to mitigate risks.

Regulatory Considerations in Different Regions

In places like Singapore, the regulatory landscape for DeFi is rapidly evolving. The Monetary Authority of Singapore (MAS) is focused on establishing clear guidelines for crypto assets by 2025. Understanding local regulations is like knowing your rights as a customer at a currency exchange; it protects you from scams and ensures fair practices in cross-chain transactions.

In conclusion, the development of Web3 edge computing and cross-chain bridges introduces both opportunities and challenges in the growing crypto ecosystem. By being informed and taking proactive measures, you can harness the benefits while minimizing risks. For more references and detailed white papers, don’t forget to check out our cross-chain security white paper.

Download our toolkit now to ensure secure cross-chain transactions!

Risk Disclosure: This article does not constitute investment advice. Consult your local regulatory authority (e.g., MAS or SEC) before engaging in cryptocurrency investments.

Using a device like the Ledger Nano X can reduce private key leak risks by 70%. Stay secure!