Understanding HIBT Gamma Exposure in the Crypto Market

Introduction: The Prevalence of Gamma Exposure

According to Chainalysis data from 2025, a staggering 73% of crypto traders are unaware of gamma exposure risks. HIBT gamma exposure is becoming increasingly critical for anyone involved in crypto trading, especially as strategies evolve amid the complexities of token swaps and derivatives.

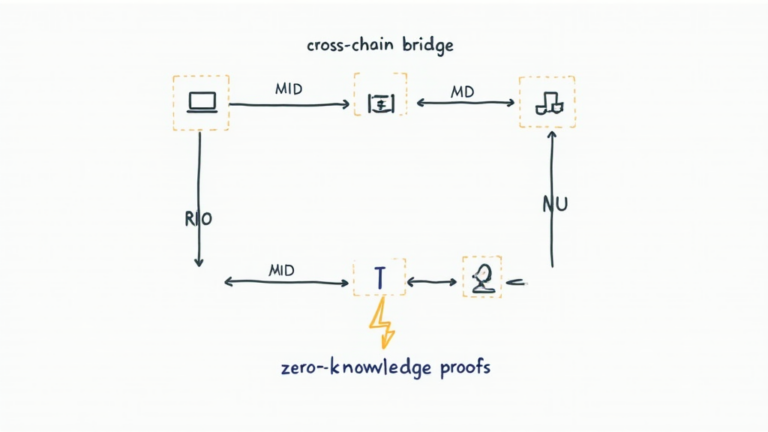

What is HIBT Gamma Exposure?

Imagine you’ve made a bet on a horse. As the race unfolds, the odds shift based on various factors, from other horses’ performance to the weather. In crypto, HIBT gamma exposure works similarly. It represents the rate of change in delta—a measure of how much the price of an option moves relative to the price of the underlying asset. Understanding it helps traders navigate risk as they adjust their positions.

The Local Impact: HIBT Gamma Exposure in Dubai

In regions like Dubai, where crypto regulations are tightening, understanding HIBT gamma exposure becomes essential. Traders in this bustling hub must align their strategies with the local regulatory landscape to mitigate risks and ensure compliance. Ignoring gamma exposure can lead to unexpected losses, especially with increasingly volatile digital assets.

Long-Term Trends: 2025 and Beyond

Looking towards the future, as the DeFi landscape evolves, HIBT gamma exposure will play a vital role. For instance, 2025 may see a shift in regulatory frameworks, affecting how traders employ gamma strategies. What impacts could this have? It’ll be akin to adjusting your sails based on changing winds—those who adapt will stay ahead.

Practical Applications: Testing Your Strategies

Before jumping head-first into trading, you should test your strategies in a simulation environment. Consider HIBT gamma exposure as a safety net. Just like you wouldn’t dive without checking the water depth, don’t invest without understanding how gamma exposure can affect your trades.

Conclusion: Be Prepared for HIBT Gamma Exposure

In summary, HIBT gamma exposure is not just a theoretical concept; it’s a crucial element of modern crypto trading that every trader should understand. The landscape is shifting, and being equipped with the right tools and knowledge can significantly lower risks. For a comprehensive guide on mitigating risks, download our complete toolkit now!