2025 Guide to HiBT Solana Trading Insights

2025 Guide to HiBT Solana Trading Insights

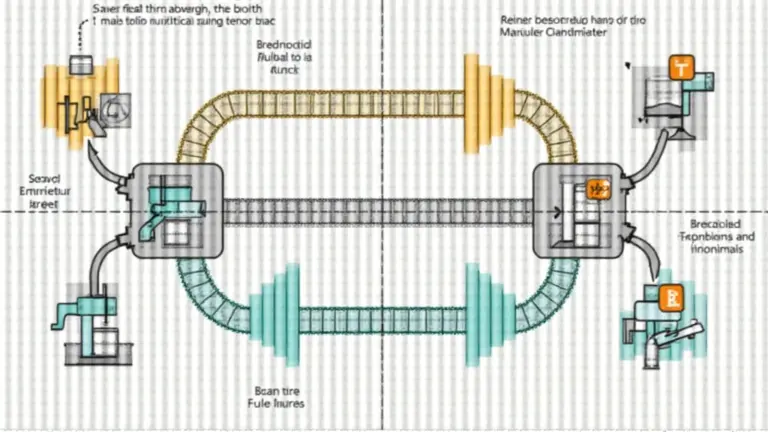

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities. As we delve into HiBT Solana trading, understanding these vulnerabilities can make all the difference in your investment strategy.

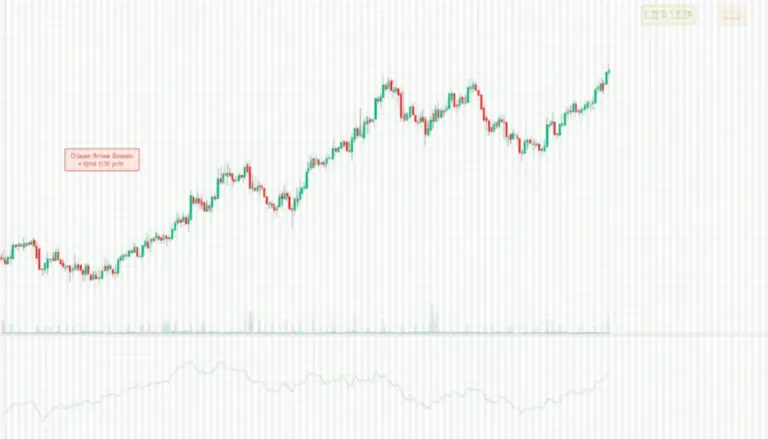

What is HiBT Solana Trading and How Does It Work?

HiBT Solana trading allows users to exchange assets seamlessly across different blockchain networks. Think of it like a foreign currency exchange booth at an airport where you can easily swap your dollars for euros. This definition highlights its importance in enhancing cross-chain interoperability.

Why Does Zero Knowledge Proof Matter in Trading?

Ever bought a coffee without revealing your bank account details? That’s what zero-knowledge proofs do. In HiBT Solana trading, they ensure your transaction privacy while confirming the validity of trade. This application is pivotal in reducing risks in 2025’s evolving regulatory landscape.

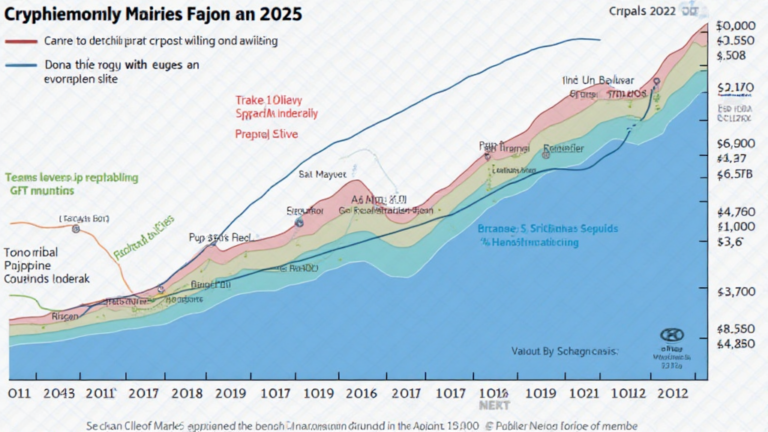

Impact of 2025 Singapore’s DeFi Regulatory Trends

With Singapore’s proactive DeFi regulations on the horizon, understanding how they affect HiBT Solana trading becomes essential for investors. Imagine navigating a city that just introduced traffic lights – while disruptive, it ultimately smooths the flow. Regulations can provide much-needed clarity in the tumultuous trading environment.

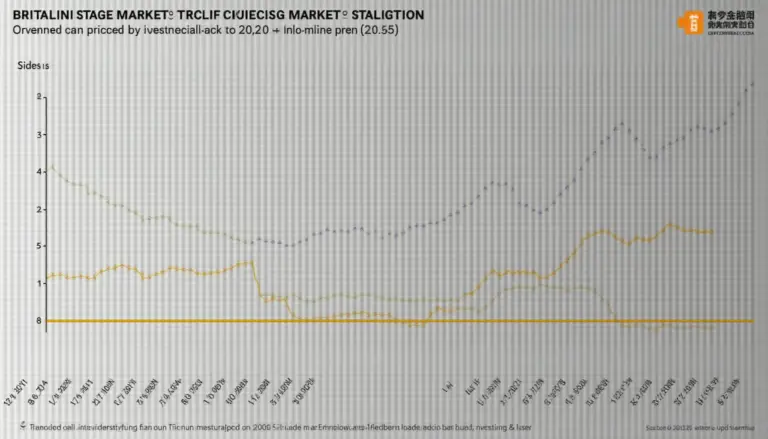

Energy Consumption Comparison Between PoS Mechanisms

When considering different Proof of Stake (PoS) mechanisms, think of it like comparing car mileage: some vehicles just consume less fuel. In the realm of HiBT Solana trading, understanding energy consumption not only impacts your investment choices but also aligns with global sustainability goals.

In summary, engaging in HiBT Solana trading opens doors to new opportunities through cross-chain interoperability and privacy-preserving technologies. As the industry evolves, keeping abreast of regulations and technical insights remains vital.

Download your investment toolkit to navigate this exciting landscape effectively.

This article does not constitute investment advice. Please consult your local regulatory body, such as MAS or SEC, before trading.

Use tools like Ledger Nano X to reduce your private key leak risks by 70%.