2026 Blockchain Innovation: Navigating the Future of Finance

Introduction: The State of Cross-Chain Bridges

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities. This highlights a pressing need for innovation in how cryptocurrencies interact. In 2026, we anticipate significant advancements in blockchain innovation, emphasizing the importance of secure and efficient transaction processes.

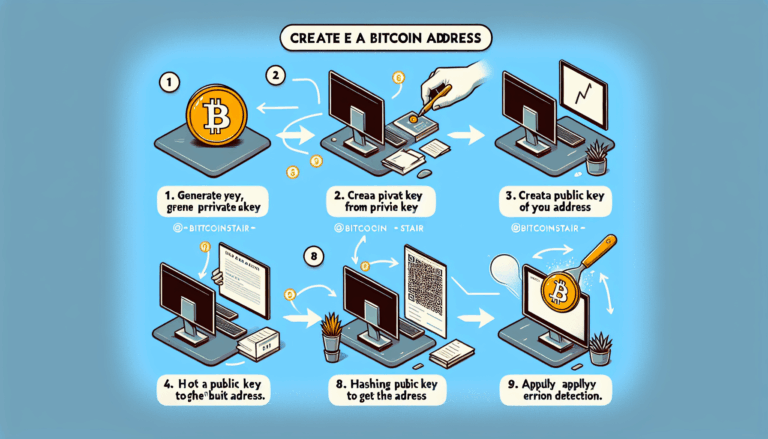

Understanding Zero-Knowledge Proofs: A Simplified Explanation

Imagine you’re at a market, trying to convince a vendor of your age without revealing your birthdate. Zero-knowledge proofs act like this—it allows one party to prove to another that they possess certain information (like their age) without revealing the actual information, thus enhancing privacy and security in transactions. As we move towards blockchain innovation 2026, these proofs will become crucial in maintaining user confidentiality in decentralized finance (DeFi).

Cross-Chain Interoperability: What You Need to Know

Cross-chain interoperability is akin to having currency exchange booths at your disposal when traveling. Just as you exchange dollars for euros, interoperability allows different blockchains (like Bitcoin and Ethereum) to work together seamlessly. This innovation will break down barriers and enhance the user experience in the crypto space by 2026, fostering deeper collaboration and integration of various blockchain systems.

The Importance of Regulation: Future Trends in DeFi

As blockchain technology evolves, so too does its regulatory landscape. In 2025, Singapore is poised to implement new DeFi regulations, reducing uncertainty and fostering growth in its crypto market. For professionals, keeping an eye on regulatory trends is critical—understanding the regulatory framework as it evolves will be essential for leveraging blockchain innovation 2026 to its fullest.

Conclusion and Call to Action

As we look ahead to 2026, it is clear that blockchain innovation will drive significant changes in finance, from improved security through zero-knowledge proofs to enhanced interoperability. For further insights, download our comprehensive toolkit on blockchain security and best practices.

Note: This article does not constitute investment advice. Always consult with local regulatory authorities like MAS or SEC before making investment decisions. For safeguarding your cryptocurrency, consider using a Ledger Nano X to reduce the risk of private key exposure by 70%.