Understanding Bull Market Profit Taking Strategies

Understanding Bull Market Profit Taking Strategies

According to recent Chainalysis data, the cryptocurrency market has seen a significant uptick in activity, creating a perfect storm for investors. As prices rise globally, the phenomenon of

What is Bull Market Profit Taking?

Bull market profit taking refers to the process of selling assets to lock in profits when prices rise. Think of it like a farmer harvesting apples when the crop is ripe rather than waiting for a potential storm that could ruin them. In 2025, investors are increasingly targeted by regulatory bodies, necessitating a thoughtful approach to profit taking.

Why Do Investors Need to Take Profits in a Bull Market?

Imagine you’re baking bread. If you leave it in the oven too long, it becomes burnt. Similarly, holding onto your investments for too long can lead to potential losses when the market turns. It’s essential to identify appropriate moments for profit taking, especially as the market buzzes with excitement around new technologies like cross-chain interoperability and zero-knowledge proofs.

When Should You Consider Taking Profits?

Timing is everything. Tracking your investments’ performance is crucial—just like checking the weather before planning a picnic. Many experts recommend taking profits in phases rather than all at once to mitigate risks. For instance, if Bitcoin hits a major milestone, this could be an ideal time to consider your strategy. In Dubai, crypto tax regulations may also affect your profit-taking timeline.

How to Execute a Profit-Taking Strategy?

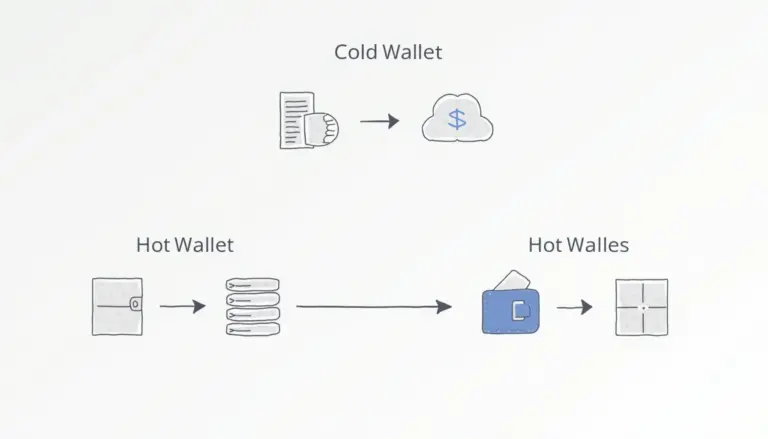

Executing a profit-taking strategy is akin to budgeting your household expenses. It involves careful planning and precise timing. Some recommend setting benchmarks for when to sell a portion of your holdings and sticking to those plans. By diversifying your approach—locking in profits from various assets, such as DeFi tokens or staking rewards—you can create a more balanced portfolio that offers a buffer against market volatility.

In conclusion, while the allure of potential profits during a bull market can be intoxicating, it’s crucial to approach profit taking with a well-thought-out strategy. Remember to keep your eyes on market indicators and regulatory changes as they unfold in regions like Singapore. For a detailed toolkit on effective profit-taking strategies, download our exclusive resource today.