2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are vulnerable to security exploits. This raises significant concerns for Vietnamese traders looking to navigate the digital asset landscape. Enter

Understanding Cross-Chain Interoperability

Imagine you need to exchange currencies at a busy market. A cross-chain bridge is like a currency exchange booth that allows you to swap different currencies (or tokens) effortlessly. However, if that booth is poorly managed, you risk losing your money.

Zero-Knowledge Proofs: A New Era of Privacy

Have you ever been in a situation where you had to show ID to prove you’re of age while buying wine? Zero-knowledge proofs (ZKP) operate similarly, allowing users to prove they have valid data without revealing the data itself. For Vietnamese traders, employing ZKP within the HiBT framework provides an extra layer of privacy and security in transactions.

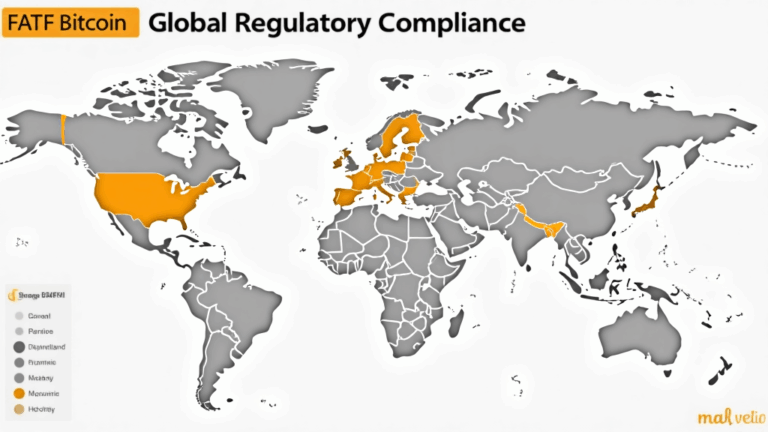

The Future of DeFi Regulation: A Focus on Vietnam

As we move towards 2025, the regulatory landscape for DeFi in regions like Singapore gives us a glimpse into potential changes worldwide, including Vietnam. Insights suggest that understanding the evolving regulatory trends can help Vietnamese traders adapt and thrive in this new environment. HiBT for Vietnamese traders can pivot to comply with future regulations effortlessly.

Energy Efficiency of PoS Mechanisms

Have you ever thought about how different modes of transport use varying amounts of fuel? Similarly, proof of stake (PoS) mechanisms consume far less energy than traditional proof of work (PoW) systems. Vietnamese traders should consider how HiBT, utilizing PoS, contributes to a sustainable trading ecosystem while minimizing their carbon footprint.

In summary,

For more insights, download our toolkit and make informed trading decisions today!

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority, such as the MAS or SEC, before engaging in any trading activities.