The Rise of DeFi Platforms in Vietnam

The Rise of DeFi Platforms in Vietnam

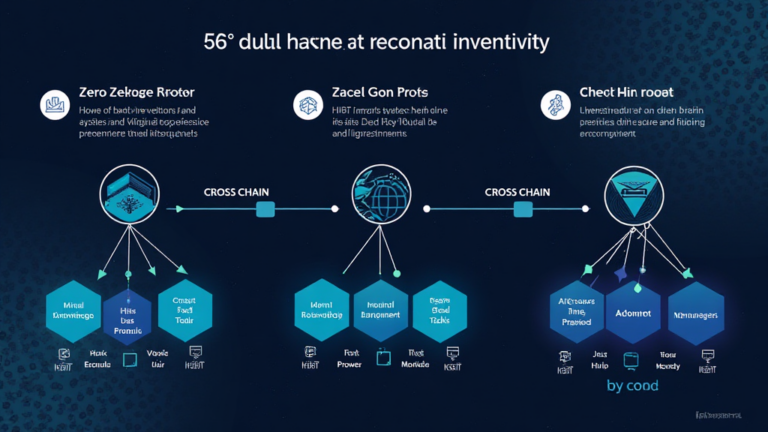

According to Chainalysis data from 2025, an astonishing 73% of cross-chain bridges face vulnerabilities. This highlights a pressing issue for the growing DeFi platforms in Vietnam, where many investors are eager to explore decentralized finance but are apprehensive about security risks.

Understanding DeFi Platforms

DeFi, or decentralized finance, is like a marketplace where you don’t need a middleman to make exchanges. Imagine a farmer at a local market selling fresh vegetables directly to customers without requiring a store. That’s what DeFi platforms offer – direct access to financial services.

Cross-Chain Interoperability Explained

Cross-chain interoperability is essential for DeFi platforms. Think of it like a currency exchange kiosk at the airport. If you’re traveling, you need to swap your money to buy things. Similarly, for a user to take advantage of various DeFi services across different blockchains, these platforms must be able to communicate with each other.

Future of DeFi Regulation in Vietnam

Looking ahead to 2025, understanding the regulatory landscape is crucial. You might have heard about how Singapore is paving the way for more structured DeFi regulations. Vietnam could follow suit, offering clearer guidelines that protect investors while encouraging innovation.

Impact of Proof of Stake on Energy Consumption

When discussing the energy consumption of Proof of Stake (PoS) mechanisms, it’s like comparing a small electric car to a gas-guzzling SUV. PoS is known for being more energy-efficient, which can be beneficial for DeFi platforms in promoting sustainability in finance.

In conclusion, DeFi platforms in Vietnam represent a dynamic frontier in finance, balancing innovation with security. Consider downloading our comprehensive toolkit to help navigate the DeFi landscape confidently.

Check out our white paper on cross-chain security!

Risk disclaimer: This article does not constitute investment advice; please consult with local regulatory bodies such as MAS or SEC before acting.

For added security, consider using Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.

Written by:

Former IMF Blockchain Advisor | ISO/TC 307 Standards Contributor | Author of 17 IEEE Blockchain Papers