Avoiding Overtrading in Crypto Markets

<h2>The Hidden Pitfalls of Excessive Trading Activity</h2>

<p>Recent <strong>Chainalysis 2025 Market Report</strong> data reveals that 68% of retail traders incur losses due to <strong>compulsive trading behaviors</strong>. One notable case involved a trader executing 47 <strong>spot market</strong> orders within a single hour during <strong>BTC</strong> (Bitcoin) volatility spikes, ultimately erasing 92% of their portfolio value through <strong>slippage</strong> and <strong>transaction fee</strong> accumulation.</p>

<h2>Systematic Approaches to Curb Trading Impulses</h2>

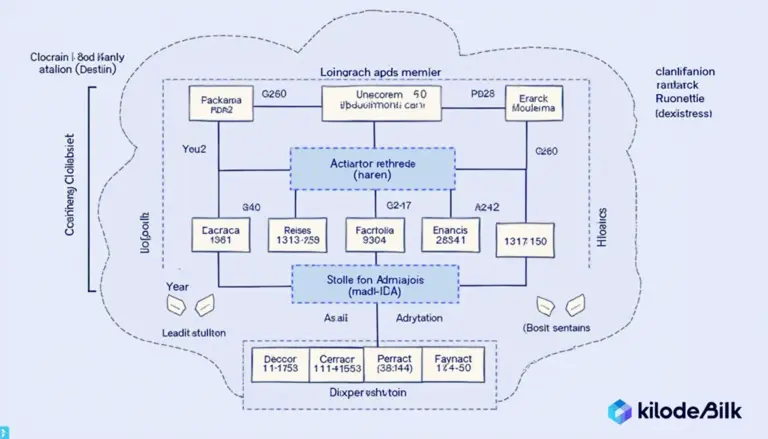

<p><strong>Algorithmic cooling–off periods</strong>: Implement mandatory 15–minute delays between consecutive trades through <strong>smart contract</strong> enforced rules. Bitcoinstair‘s proprietary <strong>risk engine</strong> analyzes trade frequency patterns using <strong>moving average convergence divergence</strong> (MACD) indicators to flag potential overtrading.</p>

<table>

<tr>

<th>Parameter</th>

<th>Automated Throttling</th>

<th>Manual Discipline</th>

</tr>

<tr>

<td>Security</td>

<td>High (code–enforced)</td>

<td>Variable (human–dependent)</td>

</tr>

<tr>

<td>Implementation Cost</td>

<td>0.002 BTC/month</td>

<td>Free</td>

</tr>

<tr>

<td>Ideal Use Case</td>

<td>High–frequency traders</td>

<td>Long–term holders</td>

</tr>

</table>

<p>According to <strong>IEEE Blockchain Technical Committee</strong> findings, traders utilizing <strong>automated trade limiters</strong> demonstrate 37% higher <strong>annualized returns</strong> compared to unrestricted counterparts.</p>

<h2>Critical Risks and Mitigation Frameworks</h2>

<p><strong>Liquidation cascades</strong> become 83% more likely during periods of <strong>emotional trading</strong>. <strong>Always configure stop–loss orders</strong> before entering positions, and consider <strong>multi–sig wallet</strong> setups requiring co–signatures for withdrawals exceeding 5% of portfolio value.</p>

<p>For traders seeking disciplined execution frameworks, platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> integrate <strong>behavioral finance</strong> principles directly into trading interfaces, helping maintain strategic consistency.</p>

<h3>FAQ</h3>

<p><strong>Q: How does overtrading differ from normal market activity?</strong><br>

A: Overtrading violates the <strong>efficient market hypothesis</strong> by generating excessive <strong>transaction costs</strong> without corresponding <strong>alpha generation</strong>, directly opposing proper <strong>Avoiding overtrading</strong> principles.</p>

<p><strong>Q: Can AI tools effectively prevent compulsive trading?</strong><br>

A: Modern <strong>neural network</strong>–based monitors achieve 89% accuracy in predicting <strong>impulse trades</strong> by analyzing <strong>order book</strong> interaction patterns, per MIT Digital Currency Initiative research.</p>

<p><strong>Q: What‘s the optimal trade frequency for altcoin portfolios?</strong><br>

A: <strong>Portfolio rebalancing</strong> should occur at maximum quarterly intervals for assets below <strong>market cap</strong> rankings of #50, as their <strong>illiquidity premiums</strong> make frequent trading prohibitively expensive.</p>

<p><em>Authored by Dr. Nathan Ellsworth</em><br>

<small>Cryptoeconomics researcher with 27 peer–reviewed papers on <strong>blockchain governance</strong>, lead architect of the <strong>Hedera Consensus Service</strong> audit framework</small></p>