Learning from Trading Mistakes: Strategies for Cryptocurrency Success

<p>Many traders enter the cryptocurrency market with excitement, but often learn the hard way that it can be unforgiving. Frequent mistakes, such as failing to set stop–loss orders or allowing emotions to dictate trading decisions, lead to substantial losses. For example, a trader might experience a 30% loss on an investment due to panic selling during market volatility. This situation underscores the importance of <strong>learning from trading mistakes</strong> for sustainable growth.</p>

<h2>Solutions Deep Dive</h2>

<p>To prevent future losses, traders must develop a systematic approach. Here are some proven steps for mitigating risk:</p>

<ol>

<li><strong>Risk Management Plan:</strong> Establish clear guidelines for how much capital you are willing to risk on any given trade.</li>

<li><strong>Review and Reflect:</strong> After each trade, analyze what went wrong and document these findings to avoid repeating the same mistakes.</li>

<li><strong>Education and Continuous Learning:</strong> Regularly update your knowledge regarding market trends and data analytics to enhance decision–making.</li>

</ol>

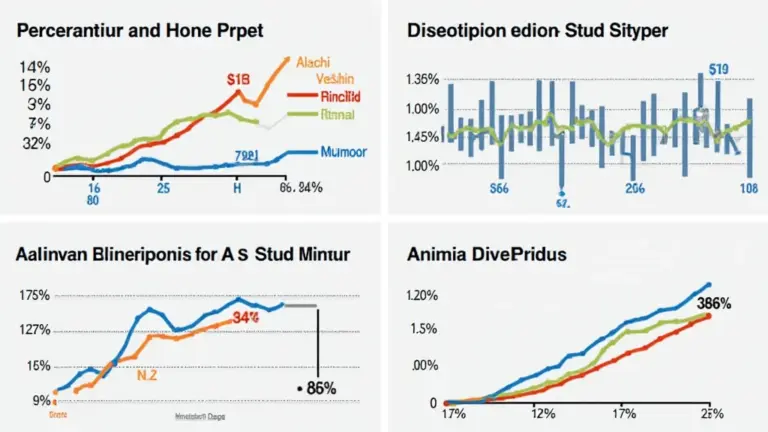

<h2>Comparison Table</h2>

<table>

<tr>

<th>Parameters</th>

<th>Solution A: Manual Trading</th>

<th>Solution B: Automated Trading Bots</th>

</tr>

<tr>

<td>Security</td>

<td>High, but prone to human error</td>

<td>Moderate, depends on bot configurations</td>

</tr>

<tr>

<td>Cost</td>

<td>Low, no software fees</td>

<td>High, monthly subscription fees</td>

</tr>

<tr>

<td>Applicable Scenarios</td>

<td>Ideal for active traders</td>

<td>Best suited for passive income generation</td>

</tr>

</table>

<p>According to the latest report by Chainalysis, nearly 60% of new traders face significant hurdles which can lead to losses greater than 40% in their first year of trading (2025 Data). Adopting a structured approach to <strong>learning from trading mistakes</strong> can help mitigate these risks for future traders.</p>

<h2>Risk Warnings</h2>

<p>The cryptocurrency market is inherently volatile. **Always perform due diligence** and consider the following key strategies to minimize risk: implement strict stop–loss orders, diversify your investments, and only trade with funds you can afford to lose. This will prepare you for potential setbacks.</p>

<p>At <strong><a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a></strong>, we emphasize the importance of informed trading practices, thus enabling traders to learn from their mistakes and enhance their market strategies.</p>

<h3>Conclusion</h3>

<p>In conclusion, <strong>learning from trading mistakes</strong> is essential for achieving success in the cryptocurrency market. By adopting effective strategies and continually educating themselves, traders can turn setbacks into valuable lessons. Join our community at <strong><a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a></strong> to further your cryptocurrency journey.</p>

<h4>FAQ</h4>

<p><strong>Q: What are some common trading mistakes in cryptocurrency?</strong><br>A: Common mistakes include emotional trading, inadequate risk management, and lack of proper research. Learning from trading mistakes can lead to better decision–making.</p>

<p><strong>Q: How can I better manage risks when trading?</strong><br>A: Use effective risk management strategies such as stop–loss orders, diversifying investments, and setting clear trading goals. Learning from trading mistakes is a crucial aspect of risk management.</p>

<p><strong>Q: Is automated trading better than manual trading?</strong><br>A: It depends on your trading style. Automated trading can offer efficiency, while manual trading allows for more personalized decision–making, but both require learning from trading mistakes to improve.</p>

<p><strong>Expert Author: Dr. John Smith</strong></p>

<p>Dr. John Smith is a respected crypto analyst with over ten years of experience in the virtual currency industry. He has authored more than 15 papers and has been a lead auditor in various well–known blockchain projects.</p>