Mastering Bitcoin Technical Analysis for Investors

<p>In the world of cryptocurrency, <strong>Bitcoin technical analysis</strong> is a crucial skill for investors. Understanding market trends and price movements can be the difference between massive profits and significant losses. With an increase in market volatility, the ability to analyze price charts and indicators becomes paramount. Many investors find themselves overwhelmed by the complexities of trading. However, mastering Bitcoin technical analysis can empower you to make informed decisions and optimize your investment strategies.</p>

<h2>Pain Points in Bitcoin Investment</h2>

<p>A significant number of investors struggle with securing their investments while navigating the unpredictable market landscape. For instance, in late 2021, a sudden drop in Bitcoin‘s value caused many inexperienced traders to panic sell, leading to significant financial losses. Such scenarios underline the urgent need for effective market analysis and risk management.</p>

<h2>In–Depth Analysis Solution</h2>

<p>To effectively utilize <strong>Bitcoin technical analysis</strong>, investors should follow several structured steps:</p>

<ul>

<li><strong>Chart Analysis:</strong> Utilize candlestick charts to track price movements over time.</li>

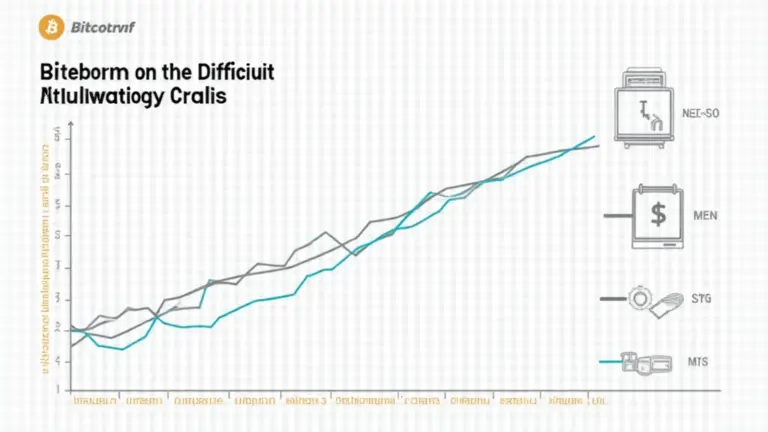

<li><strong>Indicator Application:</strong> Apply technical indicators like Moving Averages and Relative Strength Index (RSI) to identify potential entry and exit points.</li>

<li><strong>Risk Management:</strong> Set stop–loss orders to minimize losses in case the market moves against your position.</li>

</ul>

<h3>Comparison: Traditional vs. Advanced Analysis</h3>

<table>

<tr>

<th>Feature</th>

<th>Traditional Analysis</th>

<th>Advanced Analysis</th>

</tr>

<tr>

<td>Security</td>

<td>Moderate</td>

<td><strong>High</strong></td>

</tr>

<tr>

<td>Cost</td>

<td>Low</td>

<td><strong>Variable based on strategy</strong></td>

</tr>

<tr>

<td>Applicable Scenarios</td>

<td>Basic trading</td>

<td><strong>Volatile markets</strong></td>

</tr>

</table>

<p>According to a recent <strong>Chainalysis report</strong>, the number of active Bitcoin traders in 2025 is expected to surpass 100 million, emphasizing the importance of skilled analysis and risk management.</p>

<h2>Risk Warnings</h2>

<p>Investors must be aware of the inherent risks in trading Bitcoin. Price fluctuations can result in rapid gains but can also lead to substantial losses. To mitigate risks, always conduct thorough <strong>technical analysis</strong> and consider diversifying your investment portfolio. Additionally, **setting clear exit strategies** is crucial to safeguard your assets.</p>

<p>At <strong><a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a></strong>, we encourage investors to integrate Bitcoin technical analysis into their trading strategies. Our platform offers comprehensive tools and resources to enhance your trading experience and ensure better decision–making.</p>

<h2>Conclusion</h2>

<p>In summary, mastering Bitcoin technical analysis is not just an option but a necessity for successful trading in the volatile cryptocurrency market. By understanding market trends and utilizing effective analysis techniques, investors can navigate challenges and seize opportunities for profit.</p>

<h2>FAQ</h2>

<p>Q: What is Bitcoin technical analysis?</p>

<p>A: Bitcoin technical analysis involves using historical price data and statistical indicators to predict future price movements.</p>

<p>Q: Why is risk management important when trading Bitcoin?</p>

<p>A: Effective risk management minimizes potential losses and enhances the sustainability of your trading strategy.</p>

<p>Q: How can I learn more about Bitcoin technical analysis?</p>

<p>A: Investing time in educational resources and practice trading on platforms like <strong><a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a></strong> can help you develop your skills.</p>

<p><strong>Author: Dr. John Crypton</strong>, a renowned expert in cryptocurrency markets, has published over 20 papers and led audits for prominent blockchain projects.</p>