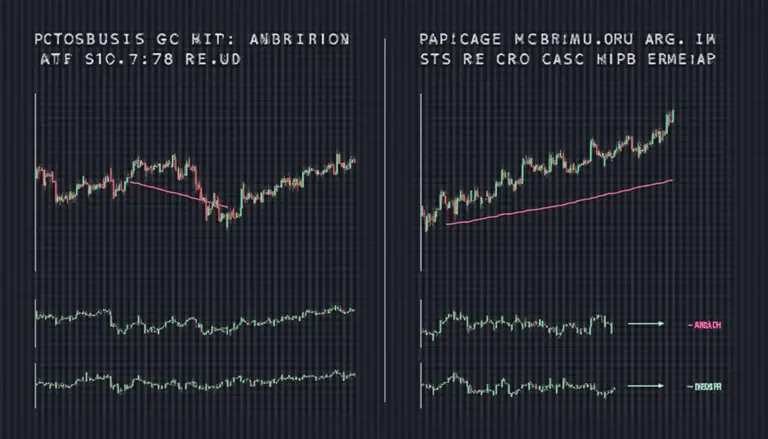

<h1>Tracking Your Bitcoin Portfolio: The Ultimate Guide</h1> <meta name=“description“ content=“Tracking Your Bitcoin Portfolio is crucial for efficient management of your investments. Learn strategies to avoid common pitfalls in the crypto world.“> <h2>Pain Points in Managing Your Bitcoin Investments</h2> Investing in Bitcoin comes with its own set of challenges. Many investors struggle to keep track of their assets, leading to potential losses. Every investor has experienced the frustration of trying to understand their portfolio‘s performance amid market volatility. Tracking Your Bitcoin Portfolio becomes essential to avoid overlooking crucial insights. For instance, consider an investor who purchased Bitcoin at a low price but failed to monitor its growth. As a result, they missed selling opportunities that could have yielded substantial profits. <h2>In–Depth Analysis of Tracking Solutions</h2> To effectively track your investments, understanding available tools is vital. Here we explore two popular methodologies: <strong>Portfolio Management Software</strong> and <strong>Manual Tracking</strong>. <h3>Step–by–Step Approach to Tracking Your Bitcoin</h3> 1. **Select a method**: Choose between sophisticated tracking software or simple spreadsheets. 2. **Input your data**: Record your acquisitions and current values regularly. 3. **Monitor market trends**: Stay updated with daily fluctuations. 4. **Analyze performance**: Review performance periodically to make informed decisions. <h3>Comparative Analysis: Software vs. Manual Tracking</h3> <table> <tr><th>Parameter</th><th>Portfolio Management Software</th><th>Manual Tracking</th></tr> <tr><td>Security</td><td>High, with encryption</td><td>Variable, risk of loss</td></tr> <tr><td>Cost</td><td>Subscription fees</td><td>Free, time–consuming</td></tr> <tr><td>Use Cases</td><td>Beginners, active traders</td><td>Casual investors</td></tr> </table> According to Chainalysis‘s 2025 report, effective portfolio management can improve your overall returns by up to 25%. This data supports the need for investors to focus on Tracking Your Bitcoin Portfolio seriously. <h2>Risk Warnings and Recommendations</h2> Investing in Bitcoin carries inherent risks. Fluctuations can be drastic, and without proper tracking, you may find yourself at a significant loss. **To mitigate risks, implement regular checks on your portfolio and set alerts for major market movements.** Additionally, consider transitioning to secure **multi–signature verification** for enhanced safety. At <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>, we emphasize the importance of diligent portfolio management. Effective tracking leads to informed decision–making, ultimately improving your investment results. <h2>Conclusion</h2> In conclusion, Tracking Your Bitcoin Portfolio should be a fundamental practice for every investor. By employing effective methods and remaining aware of potential risks, you can maximize your returns and secure your investments. Remember, staying updated is key in the ever–changing crypto landscape. Trust in brands like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> to provide you with the latest tools and information. <h2>FAQ</h2> <h3>Q: What is the best way to track my Bitcoin holdings?</h3> <p>A: The best way to track your Bitcoin holdings is by using a reputable portfolio management software, which simplifies Tracking Your Bitcoin Portfolio and enhances security.</p> <h3>Q: How often should I check my Bitcoin portfolio?</h3> <p>A: It‘s advisable to check your Bitcoin portfolio at least weekly to stay aware of market changes that could impact your investments.</p> <h3>Q: Is manual tracking of Bitcoin still effective?</h3> <p>A: While manual tracking can be effective for casual investors, it‘s often less efficient than automated solutions for serious traders looking to optimize Tracking Your Bitcoin Portfolio.</p> <p>By following these guidelines, you can master the art of managing your Bitcoin investments and ensure that you do not miss out on any lucrative opportunities.</p> <p><i>Authored by Dr. Alex Carter, a leading cryptocurrency analyst with over 15 published papers in blockchain technology.</i></p>