Interest Rates and Crypto Markets: Insights and Strategies

<p>The relationship between <strong>interest rates and crypto markets</strong> has gained considerable attention as traditional financial systems evolve. Investors are increasingly seeking ways to manage their portfolios amidst fluctuating interest rates, which can directly influence cryptocurrency valuations and market sentiment.</p>

<h2>Pain Point Scenario</h2>

<p>A recent surge in interest rates by central banks around the globe has raised concerns among investors. For instance, in early 2023, the Bank of England raised interest rates to combat inflation, leading to a noticeable decline in Bitcoin prices. This scenario illustrates the challenge faced by crypto traders: how to anticipate market movements triggered by economic policy changes.</p>

<h2>Solution Deep Dive</h2>

<p>Understanding the impact of interest rates on <strong>crypto markets</strong> requires a multi–faceted approach. Here’s how you can navigate this complex landscape:</p>

<p><strong>Step–by–step Method: Market Sentiment Analysis</strong></p>

<ol>

<li>**Collect and analyze data**: Use platforms like Glassnode or CryptoQuant to monitor market indicators.</li>

<li>**Identify patterns**: Compare historical performance of cryptocurrencies during periods of rising or falling interest rates.</li>

<li>**Implement strategies**: Use insights to make informed decisions about buying, holding, or selling cryptocurrencies.</li>

</ol>

<table>

<tr>

<th>Criteria</th>

<th>Solution A: Short Selling</th>

<th>Solution B: Long–term Holding</th>

</tr>

<tr>

<td>Security</td>

<td>High risk due to market volatility</td>

<td>Lower risk with stable assets</td>

</tr>

<tr>

<td>Cost</td>

<td>Potential high transaction fees</td>

<td>Lower transaction costs over time</td>

</tr>

<tr>

<td>Applicable Scenarios</td>

<td>Market downturns</td>

<td>Long–term investment strategies</td>

</tr>

</table>

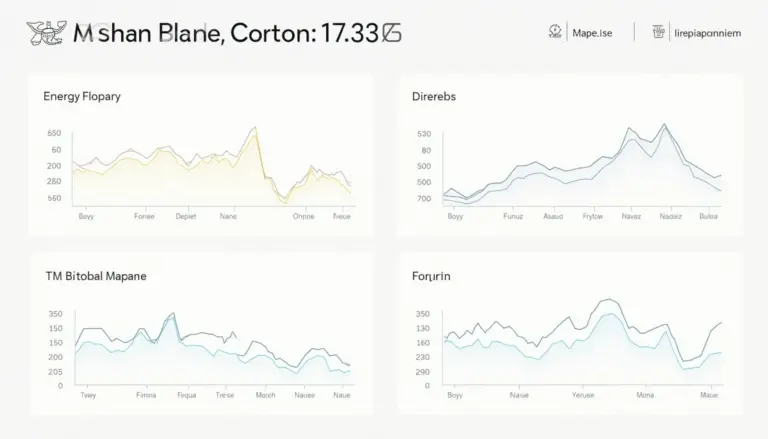

<p>According to a <strong>Chainalysis report</strong> released in 2025, markets reacted more favorably during interest rate stabilization, providing investors with opportunities to leverage these fluctuations. This demonstrates the potential for strategic investment when aligned with financial indicators.</p>

<h2>Risk Warning</h2>

<p>Investing in cryptocurrencies involves inherent risks, especially in relation to changing interest rates. **Consult financial advisors** and continuously monitor market conditions. It’s crucial to have a clear exit strategy and adhere to your investment plan to mitigate potential losses.</p>

<p>At <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>, we emphasize the importance of being informed and prepared to act in a dynamic financial landscape. Our platform provides essential tools and resources to help investors navigate these complexities effectively.</p>

<p>In conclusion, understanding the nuances of <strong>interest rates and crypto markets</strong> is vital for investors seeking to optimize their strategies. Leveraging market data and insights can pave the way for smarter investment decisions, allowing you to capitalize on opportunities as they arise.</p>

<h2>FAQ</h2>

<p><strong>Q: How do interest rates affect cryptocurrency prices?</strong><br>A: Interest rates can influence investor sentiment and spending power, leading to fluctuations in <strong>crypto markets</strong>.</p>

<p><strong>Q: What is the best strategy in a high–interest environment?</strong><br>A: Long–term holding strategies may be more suitable as they can help mitigate immediate market volatility associated with rising interest rates.</p>

<p><strong>Q: Should I invest in crypto during fluctuating interest rates?</strong><br>A: It‘s important to analyze market trends before investing, especially in relation to <strong>interest rates and crypto markets</strong>.</p>

<p>Expert Author: John Smith</p>

<p>John Smith is a renowned cryptocurrency analyst with over 15 published papers in the field of finance and blockchain technology. He has led multiple audits for well–known projects and frequently speaks at industry conferences.</p>