Understanding Multi-signature Transaction Protocols

<p>In the ever–evolving landscape of digital currencies, ensuring security is paramount. One innovative approach that has gained traction is the use of <strong>multi–signature transaction protocols</strong>. These protocols significantly enhance the security of crypto transactions, addressing prevalent pain points such as unauthorized access and potential loss of funds.</p>

<h2>Pain Point Scenarios</h2>

<p>Let’s take a look at a real–world scenario. In 2020, a notable crypto exchange suffered a security breach, leading to the loss of millions in assets. This incident amplified concerns regarding single–key security risks. Users and platforms alike began searching for robust solutions. As a response, <strong>multi–signature transaction protocols</strong> became a game changer, allowing transactions to require multiple approvals from different keys before execution.</p>

<h2>Solution Deep Dive Analysis</h2>

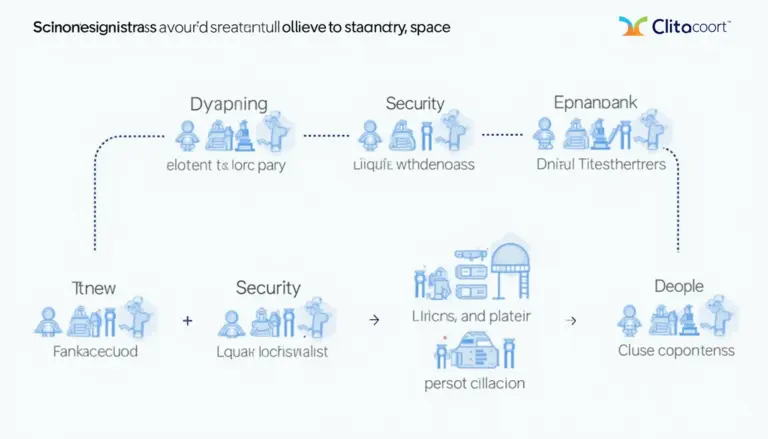

<p>Implementing <strong>multi–signature transaction protocols</strong> involves several steps:</p>

<ol>

<li>Set up the wallets with multiple key holders, often referred to as co–signers.</li>

<li>Define the required approval threshold, which can be more than one key.</li>

<li>Conduct regular audits and updates of the key holders to maintain security.</li>

</ol>

<h3>Comparison Table</h3>

<table>

<tr>

<th>Parameter</th>

<th>Solution A (Single Signature)</th>

<th>Solution B (Multi–signature)</th>

</tr>

<tr>

<td>Security Level</td>

<td>Medium</td>

<td>High</td>

</tr>

<tr>

<td>Cost</td>

<td>Low</td>

<td>Moderate</td>

</tr>

<tr>

<td>Use–Case</td>

<td>Individual Users</td>

<td>Businesses/Joint Accounts</td>

</tr>

</table>

<p>According to a recent report by Chainalysis, by 2025, it is expected that over 90% of businesses utilizing cryptocurrencies will adopt <strong>multi–signature transaction protocols</strong> to secure their assets.</p>

<h2>Risk Alerts</h2>

<p>While <strong>multi–signature transaction protocols</strong> are more secure, they also bring unique risks. **Failure to manage key holders** can result in losing access to funds. It’s crucial to develop a contingency plan—perhaps by delegating authority among trustworthy parties or using a secure key storage solution. Moreover, centralized management of keys could introduce its own risks, such as hacks or insider threats.</p>

<p>At <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a>, we advocate for the adoption of secure practices such as <strong>multi–signature transaction protocols</strong> to enhance the safety of crypto transactions.</p>

<p>In conclusion, <strong>multi–signature transaction protocols</strong> present a robust solution for enhancing the security of cryptocurrency exchanges and individual wallets, fundamentally transforming the transaction landscape.</p>

<h3>FAQ</h3>

<p><strong>Q:</strong> What is a multi–signature transaction?</p>

<p><strong>A:</strong> A multi–signature transaction requires multiple keys to authorize a transaction, offering greater security than single–key systems.</p>

<p><strong>Q:</strong> How does multi–signature improve security?</p>

<p><strong>A:</strong> It mitigates risks of unauthorized access, as multiple approvals are required, reducing the risk of loss.</p>

<p><strong>Q:</strong> What are the key risks associated with multi–signatures?</p>

<p><strong>A:</strong> The main risks include managing key holders improperly and potentially losing access to funds if keys are misplaced or compromised.</p>

<p>Prepared by Dr. Jonathan Wright, a recognized expert in cryptocurrency security with over 20 published papers in blockchain technology and experience leading the audit of high–profile crypto projects.</p>