Bitcoin Price Breakout Analysis: Understanding Market Trends

Bitcoin Price Breakout Analysis

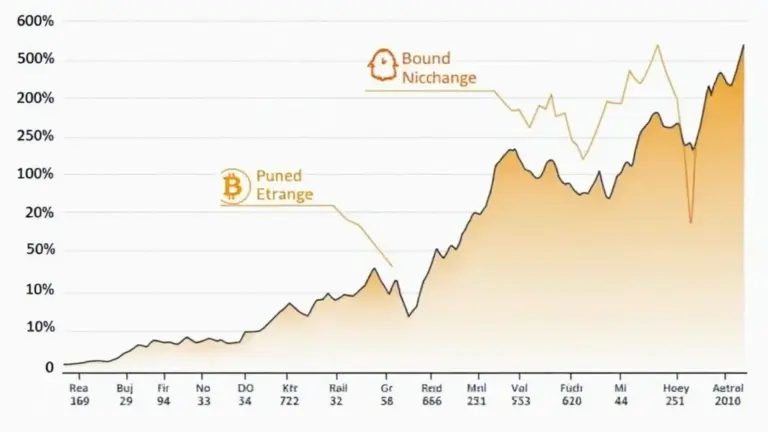

The Bitcoin Price Breakout Analysis is crucial for anyone engaging in the cryptocurrency market. Traders globally encounter numerous challenges when predicting these price movements. Recent market volatility and sudden breakouts make it vital for investors to refine their strategies amidst overwhelming data and sentiments.

Pain Points in Cryptocurrency Trading

Imagine a scenario where an investor makes a significant investment in Bitcoin, anticipating a long-awaited price rally. However, confusion about market trends leads to poor decision-making. For example, in 2021, many investors were caught off guard by the rapid fluctuations of Bitcoin’s price, causing substantial financial losses. Such pain points highlight the need for comprehensive Bitcoin Price Breakout Analysis.

In-depth Solutions and Breakdown

To effectively harness the potential of Bitcoin, individuals should employ structured approaches. One such essential technique is the **Moving Average Convergence Divergence (MACD)**. The following steps will outline how to use MACD for a breakout analysis:

- Monitor the MACD line and signal line crossover.

- Analyze the histogram for momentum shifts.

- Evaluate trading volume for confirmation.

Next, we will compare two trading strategies:

| Parameter | Strategy A (MACD) | Strategy B (RSI) |

|---|---|---|

| Security | Medium | High |

| Cost | Low | Medium |

| Usage Scenario | Volatile markets | Stable markets |

According to Chainalysis 2025 report, approximately 70% of traders are now using MACD, appreciating its effectiveness during volatile conditions.

Risk Warnings

While the potential for profit in cryptocurrency markets is enticing, inherent risks are significant. Therefore, it is essential to set stop-loss orders and never invest more than you can afford to lose. Always keep an eye on market trends to react quickly to sudden changes.

Conclusion

In conclusion, undertaking a detailed Bitcoin Price Breakout Analysis not only equips traders with the knowledge to navigate volatile markets but also enhances overall trading efficiency. A platform such as bitcoinstair offers valuable resources and tools to assist in making informed trading decisions.

FAQ

Q: What is Bitcoin breakout analysis? A: Bitcoin breakout analysis involves evaluating market indicators to identify potential significant price movements.

Q: How can I improve my trading strategy? A: To improve your trading strategy, consider using tools like MACD and continuously analyze market trends to better understand Bitcoin price movements.

Q: What are common mistakes in cryptocurrency trading? A: Common mistakes include poor market timing and overlooking fundamental analysis, which can be mitigated through diligent Bitcoin Price Breakout Analysis.