Bitcoin Institutional Adoption Rates: A Closer Look

Bitcoin Institutional Adoption Rates: A Closer Look

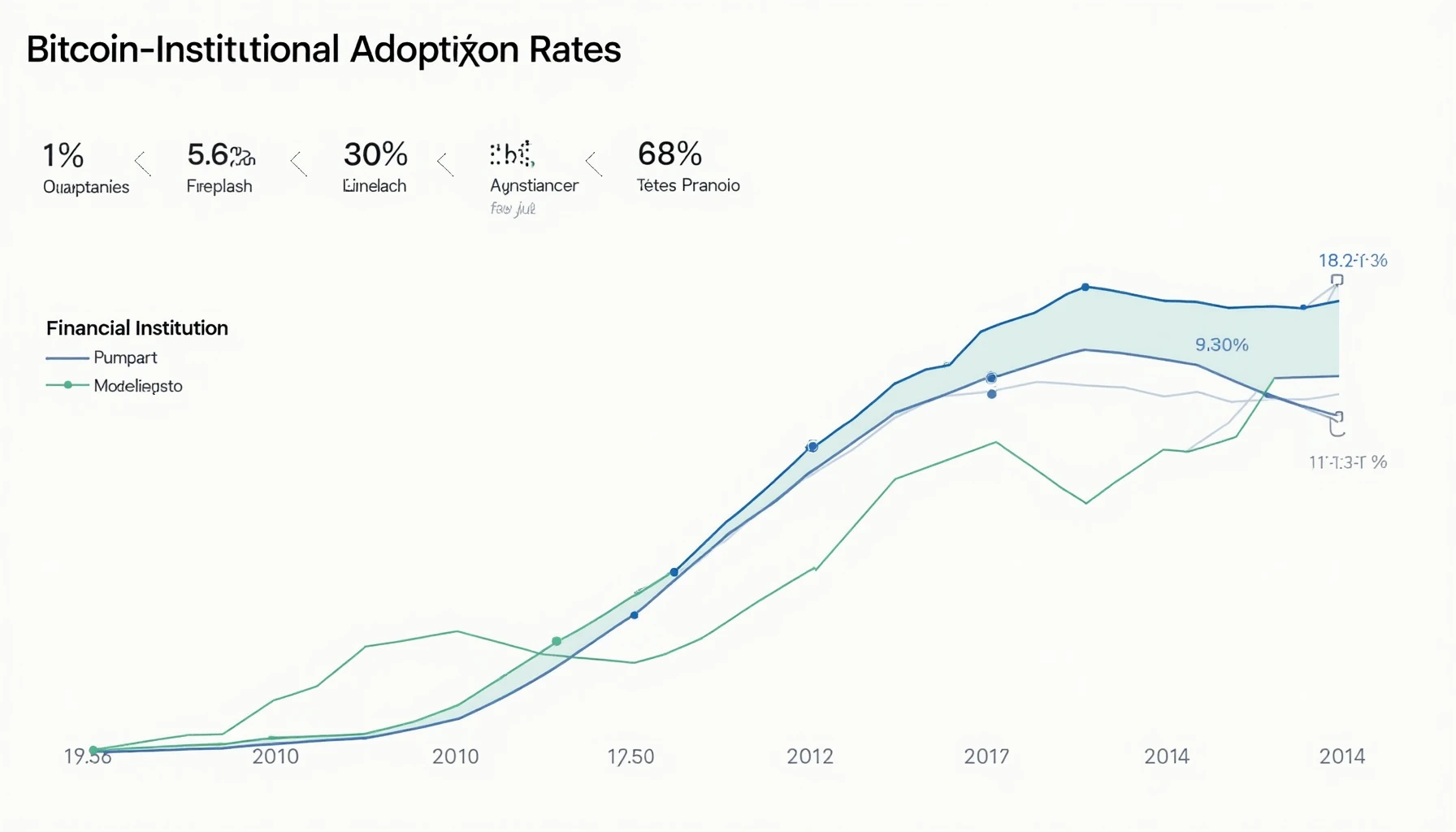

The exponential rise of Bitcoin has led to significant interest from financial institutions. The Bitcoin Institutional Adoption Rates have become a pivotal metric, as many organizations are exploring how to integrate this digital asset into their portfolios. However, institutions face several pain points when considering this adoption.

Pain Point Scenarios

For instance, a major hedge fund found itself in a dilemma over how to incorporate Bitcoin effectively while mitigating risks. The demand for digital assets is undeniable, but many institutions struggle with regulatory compliance and technology integration. As these organizations seek to adapt, understanding Bitcoin Institutional Adoption Rates becomes crucial for their strategic planning.

Solution Deep Dive

To assist institutions, we have compiled a comprehensive analysis of the key strategies available for effectively adopting Bitcoin.

1. Multi-Signature Verification: A method that involves multiple signatures for validating transactions. This increases the security layers, making it less prone to fraud.

2. Custodial Services: Utilizing services that manage and store cryptocurrencies safely, thus enabling institutions to focus on their core operations while ensuring asset security.

3. Regulatory Compliance Frameworks: Establishing a clear understanding of the evolving regulatory landscape surrounding Bitcoin and digital assets.

| Parameters | Option A: Multi-Signature Verification | Option B: Custodial Services |

|---|---|---|

| Security | High | Moderate |

| Cost | Medium | High |

| Applicability | Recommended for larger holdings | Great for institutions new to crypto |

According to the latest Chainalysis report from 2025, institutional adoption rates of Bitcoin are projected to increase by over 30% as more institutions recognize the advantages of diversifying their portfolios with digital assets.

Risk Warning

Despite the benefits, it is essential to remain vigilant. Key risks include market volatility, regulatory changes, and potential cybersecurity threats. To mitigate these risks, institutions should implement robust security measures and consider diverse investment strategies to spread risk.

At bitcoinstair, we understand the complexities involved in navigating the cryptocurrency landscape. Our platform provides tailored resources and expert insights for institutions looking to enhance their Bitcoin journeys.

In conclusion, understanding the Bitcoin Institutional Adoption Rates is crucial for any financial organization wanting to remain competitive in the evolving market. By considering proven strategies and potential risks, institutions can significantly optimize their approach to cryptocurrency.

FAQ

Q: What factors influence Bitcoin institutional adoption rates?

A: Factors include regulatory clarity, market trends, and security considerations, all of which contribute to increased Bitcoin Institutional Adoption Rates.

Q: Are there specific security measures that institutions should take?

A: Institutions should consider using multi-signature verification and custodial services for enhanced security.

Q: How can institutions stay ahead in the cryptocurrency market?

A: By continuously monitoring market trends and adjusting their strategies to fit the Bitcoin Institutional Adoption Rates. This approach will ensure they remain competitive.