Understanding Bitcoin Price Cycle Patterns: A Comprehensive Guide

Understanding Bitcoin Price Cycle Patterns

The volatility of Bitcoin has intrigued both novice and seasoned investors alike. Understanding Bitcoin Price Cycle Patterns is crucial for making informed investment decisions. The price of Bitcoin fluctuates in noticeable cycles, influencing the market landscape and investor strategies.

Pain Points in Bitcoin Trading

Many traders experience uncertainty during bearish trends, leading to panic selling. For instance, during the 2017 bull market, many investors entered the market at its peak, only to face significant losses during the subsequent downturn. Recognizing price cycle patterns would have provided insights into optimal buy and sell points, potentially avoiding significant losses.

In-Depth Analysis of Bitcoin Price Cycle Patterns

Analyzing the Bitcoin Price Cycle Patterns involves understanding several methodologies. Here are steps to effectively analyze these cycles:

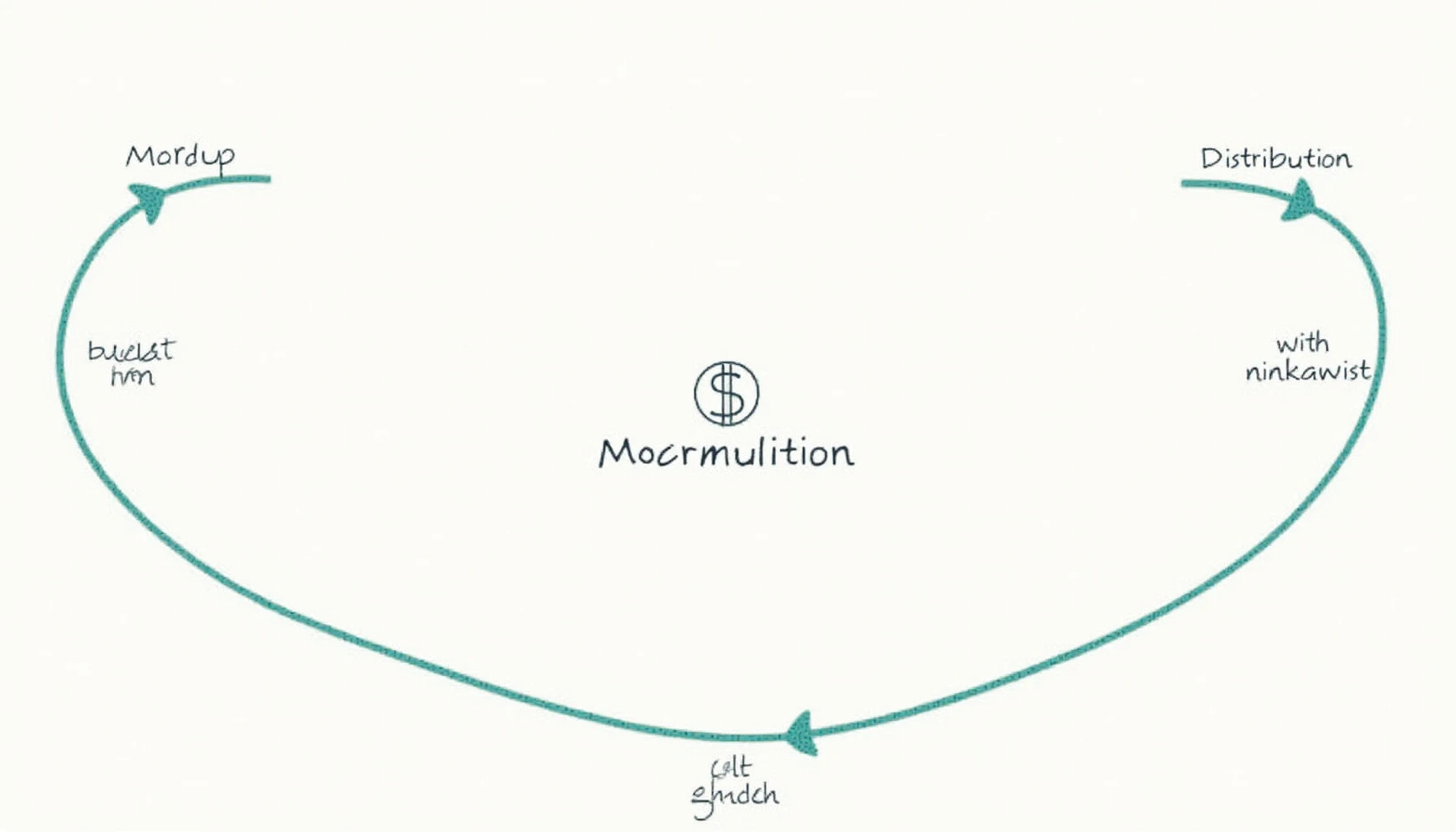

- Identify Market Phases: Recognize the accumulation, markup, distribution, and markdown phases.

- Technical Analysis: Utilize tools such as Moving Averages and Relative Strength Index (RSI) for trend analysis.

- Market Sentiment Analysis: Assess news articles and social media sentiment around Bitcoin.”

| Criteria | Trading Strategy A | Trading Strategy B |

|---|---|---|

| Security | High risk due to market volatility | Moderate risk with hedging strategies |

| Cost | Low transaction fees | Higher fees due to advanced tools |

| Applicability | Suitable for short-term traders | Ideal for long-term investors |

According to a 2025 report by Chainalysis, market behaviors are increasingly predictable based on historical Bitcoin Price Cycle Patterns, indicating that informed trading strategies can drastically improve success rates.

Risk Warnings in Bitcoin Trading

Investing in Bitcoin carries inherent risks, including market volatility and regulatory changes. To minimize potential losses, it’s essential to diversify your portfolio and implement stop-loss mechanisms. Furthermore, conducting thorough research and understanding specific market cycles can enhance your trading strategy.

At bitcoinstair, we provide resources and tools to help you navigate these complexities and optimize your trading strategies efficiently.

Conclusion

Understanding Bitcoin Price Cycle Patterns is fundamental for anyone looking to invest successfully in the cryptocurrency market. By analyzing historical data and applying strategic methods, traders can better position themselves to mitigate risks and capitalize on market opportunities.

FAQ

Q: What are Bitcoin price cycle patterns?

A: Bitcoin price cycle patterns refer to the predictable fluctuations in Bitcoin’s market price through various market phases.

Q: How can I apply Bitcoin price cycle patterns in trading?

A: Utilizing technical analysis tools and market sentiment analysis can help you effectively leverage Bitcoin price cycle patterns in your trading strategy.

Q: What is the risk of trading Bitcoin?

A: The risks of trading Bitcoin include high volatility and market unpredictability. It is advisable to diversify and employ risk management strategies.