Bitcoin Price Manipulation Risks: Understand and Mitigate

Bitcoin Price Manipulation Risks: Understand and Mitigate

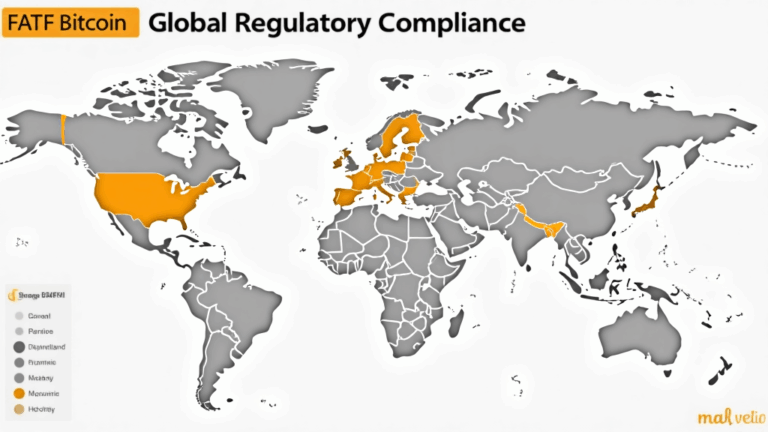

The virtual currency market is increasingly complex, and one of the pressing concerns for investors is the Bitcoin price manipulation risks. These risks can lead to devastating losses for unsuspecting traders. With the rise of decentralized finance (DeFi) and institutional investors entering the space, understanding how market dynamics can be influenced is crucial.

Pain Point Scenarios

In recent years, we have witnessed multiple instances where sudden spikes and drops in Bitcoin prices left many investors bewildered. A notable case involved a sudden price surge attributed to social media hype, leading to panic selling that resulted in a significant market downturn. This phenomenon highlights the risks of price manipulation and its impact on individual investors seeking to capitalize on momentum.

Solution Deep Dive

To combat the threats posed by Bitcoin price manipulation, investors should consider the following approaches:

1. **Multi-Signature Verification**: Using transactions that require multiple keys to authorize transfers can significantly reduce the risk of unauthorized access and manipulation.

2. **Automated Trading Systems**: Implementing high-speed trading algorithms can provide timely market responses, thus minimizing potential losses caused by sudden price fluctuations.

3. **In-depth Market Research Tools**: Utilize platforms that offer comprehensive market analytics to identify unusual trading patterns that signal potential manipulation.

| Parameters | Solution A | Solution B |

|---|---|---|

| Security | High | Medium |

| Cost | Moderate | Low |

| Application | High-risk trading | Long-term investments |

According to the latest Chainalysis report, it is anticipated that by 2025, sophisticated price manipulations could affect up to 15% of market transactions. This data underlines the importance of adopting various protective measures against Bitcoin price manipulation risks.

Risk Warning

The virtual currency space is fraught with risks, particularly related to price manipulation. To mitigate these concerns, investors should actively research and employ advanced trading techniques that offer layers of security. Diversification and employing automated systems can help safeguard investments while navigating the often volatile market.

At bitcoinstair, we prioritize educating our users about Bitcoin price manipulation risks and providing tools to safeguard against them.

In conclusion, understanding the intricacies of the virtual currency market and the common risks associated with Bitcoin price fluctuations is essential for informed trading. Applying proactive strategies can significantly mitigate the dangers of manipulation and enhance your investment strategy.

FAQs

Q: What are Bitcoin price manipulation risks?

A: Bitcoin price manipulation risks refer to the potential for large market movements caused by coordinated efforts or misinformation, which may adversely affect investors.

Q: How can I protect myself against Bitcoin price manipulation?

A: To protect yourself against Bitcoin price manipulation risks, utilize tools such as **multi-signature verification** and automated trading systems while performing thorough market analysis.

Q: Is it safe to invest in Bitcoin?

A: While Bitcoin investments carry risks, understanding Bitcoin price manipulation risks and employing protective strategies can enhance your safety in the market.