Bitcoin Price Discovery Process: Understanding Market Dynamics

Pain Points in Bitcoin Price Discovery

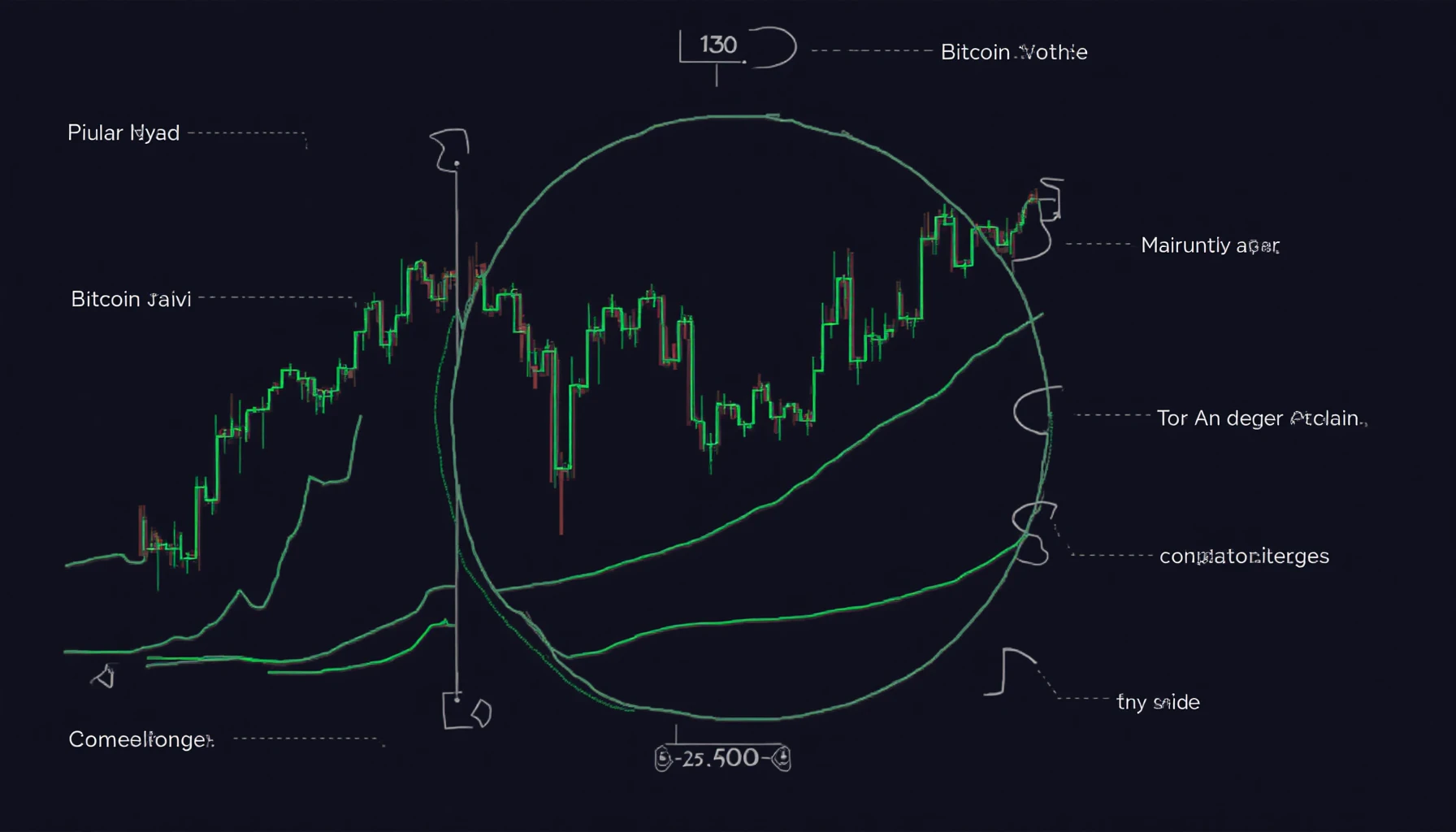

The Bitcoin price discovery process is a critical factor affecting both novice and seasoned investors in the crypto space. The volatility inherent to digital currencies creates yet another layer of complexity for traders and users alike, often resulting in anxiety due to fluctuating market conditions. For instance, during the dramatic drop in Bitcoin prices in May 2021, many investors faced heavy losses, emphasizing the necessity to understand the underlying processes at play.

In-Depth Analysis and Solutions

Understanding the Bitcoin price discovery process involves analyzing various technical methodologies that contribute to price formation. Here, we will break down the steps involved in this complex mechanism:

Step 1: Market Sentiment Analysis – Gauge market sentiment by studying news, social media trends, and overall trading volume.

Step 2: Order Book Dynamics – Examine the order book to determine supply-demand balance at various price levels.

Step 3: Market Maker Strategies – Investigate how market makers influence liquidity and price adjustments.

Comparison Table: Option A vs. Option B

| Parameters | Option A (Technical Analysis) | Option B (Fundamental Analysis) |

|---|---|---|

| Security | Moderate | High |

| Cost | Low | High |

| Applicable Scenarios | Short-term trading | Long-term investment |

According to a recent Chainalysis report, the average price of Bitcoin is expected to stabilize around $60,000 by 2025, underlining the importance of understanding the Bitcoin price discovery process.

Risk Warnings

While engaging with cryptocurrencies, potential risks can arise, including market manipulation, regulatory changes, and technological flaws. It is essential to diversify your investments to build resilience against sudden market changes.

At this juncture, using a platform like bitcoinstair can allow users to safeguard their investments by offering analytical tools and real-time data critical for navigating the volatile landscape.

In conclusion, the Bitcoin price discovery process is multifaceted and essential for anyone wanting to succeed in cryptocurrency investment. Understanding market dynamics provides investors with a foundation to make informed decisions.