Understanding Bitcoin Hard Fork Coordination

Understanding Bitcoin Hard Fork Coordination

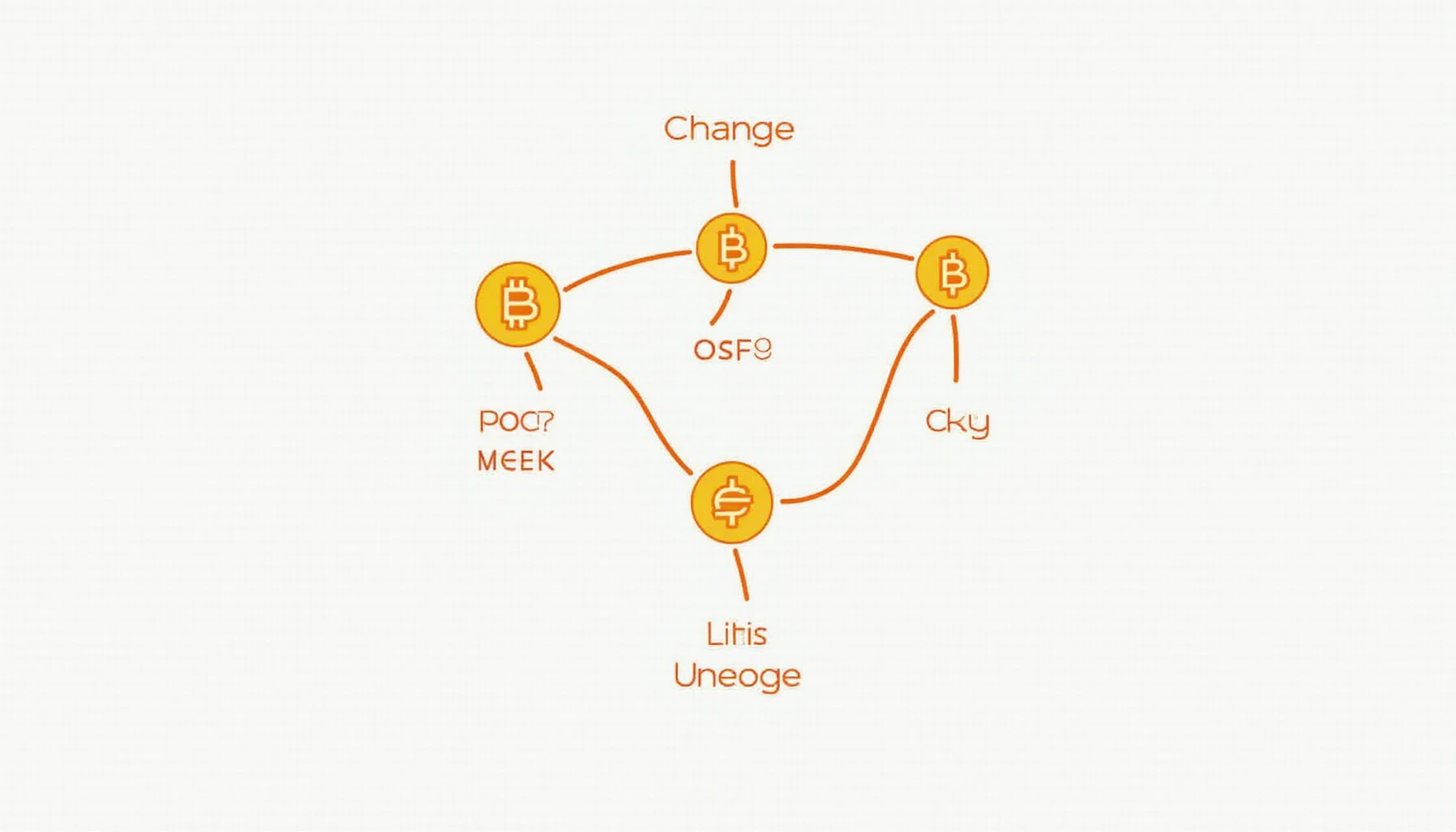

In the fast-evolving world of cryptocurrency, Bitcoin hard fork coordination stands as a critical issue that affects both developers and investors. As users navigate potential disruptions following a hard fork, concerns arise regarding transaction integrity, network compatibility, and overall blockchain sustainability. A hard fork can lead to the creation of two separate versions of Bitcoin, leading to uncertainty and fragmentation within the network.

Pain Points Encountered During Hard Forks

When considering a hard fork, participants face numerous challenges. For example, during the Bitcoin Cash fork in 2017, users experienced not only confusion about which chain to follow but also significant volatility in their asset value. Ioannis K. from Greece testified that he lost a substantial amount due to uncoordinated efforts during the fork.

Comprehensive Solutions for Coordination

To mitigate the risks associated with Bitcoin hard fork coordination, it is essential to follow a structured approach. Here are the steps:

- Community Engagement: Foster active dialogue within the community.

- Technical Consensus: Achieve agreement on the changes necessary.

- Implementation Planning: Develop a timeline for the roll-out of the hard fork.

Comparative Analysis of Coordination Strategies

| Parameters | Strategy A: Centralized Coordination | Strategy B: Decentralized Coordination |

|---|---|---|

| Security | Moderate | High |

| Cost | Low | Higher |

| Applicable Scenarios | Quick forks | Community-driven forks |

According to a 2025 report by Chainalysis, security threats during hard forks can lead to losses exceeding $300 million, highlighting the importance of effective coordination.

Risks and Mitigation Strategies

The landscape of cryptocurrency is fraught with risks. In the realm of Bitcoin hard fork coordination, potential risks include loss of funds, lack of community consensus, and network instability. It is crucial to perform thorough due diligence and maintain open channels of communication before, during, and after any forking event to avoid these pitfalls.

It is advisable to implement robust testing environments prior to executing hard forks to prevent unexpected issues that may arise from the changes.

At bitcoinstair, we provide our users with the latest tools and resources to navigate these challenges effectively.

Conclusion

In conclusion, Bitcoin hard fork coordination plays a pivotal role in the cryptocurrency ecosystem. Thorough planning and community involvement are essential to minimize risks associated with hard forks. By utilizing structured solutions and strategies, participants can safeguard their investments and contribute positively to the development of the Bitcoin network.

FAQ

Q: What is a Bitcoin hard fork?

A: A Bitcoin hard fork occurs when there is a significant change to the Bitcoin protocol, resulting in the creation of a new blockchain. Effective Bitcoin hard fork coordination is necessary to manage this transition smoothly.

Q: How can I ensure my assets are secure during a hard fork?

A: Keeping updated on community announcements and utilizing secure wallets can help protect your assets during a hard fork.

Q: What are the common risks of participating in a hard fork?

A: The common risks include transaction complications, loss of investment, and network instability, making Bitcoin hard fork coordination crucial for safety.