Bitcoin Network Hash Rate Guide: Understanding the Metrics and Implications

Bitcoin Network Hash Rate Guide: Understanding the Metrics and Implications

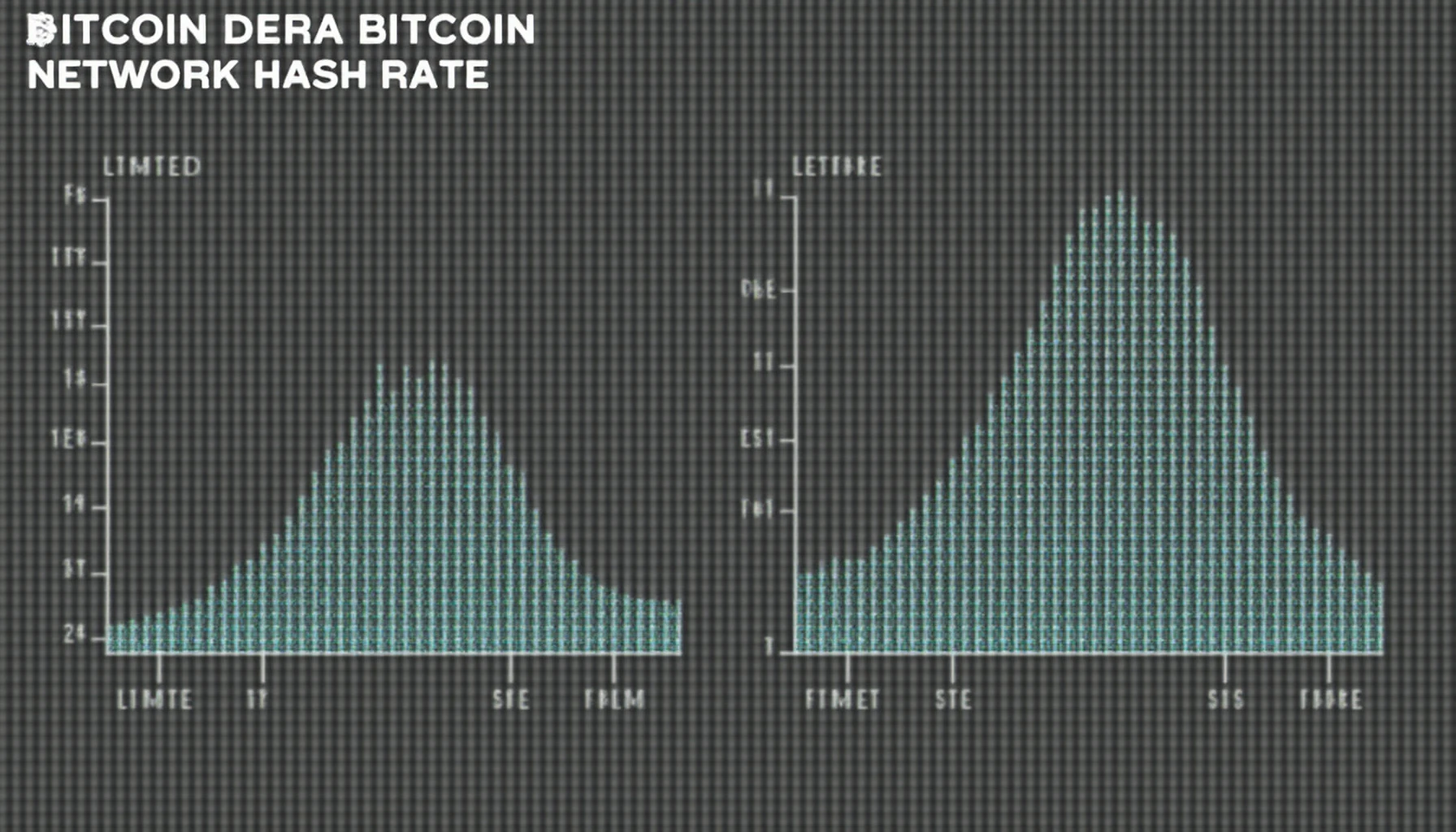

Did you know that as of 2023, the Bitcoin network hash rate has surged to over 200 EH/s, marking a critical metric indicating network security and mining profitability? Understanding this metric is essential for anyone looking into cryptocurrency investments or considering diving into digital currency transactions.

What is Hash Rate and Why Does it Matter?

In simple terms, the hash rate is the speed at which a cryptocurrency miner can complete operations and solve cryptographic puzzles. Higher hash rates enhance the security of the Bitcoin network, making it less vulnerable to attacks while also influencing the blockchain technology dynamics significantly.

Hash Rate’s Role in Blockchain Security

- The greater the hash rate, the more secure the network becomes.

- Investors often view a rising hash rate as a sign of a healthy network.

For instance, if the hash rate decreases significantly, it may lead to slower transaction confirmations and a higher possibility of double spending — a risk any investor should be wary of.

How is Hash Rate Calculated?

The hash rate is generally calculated as the number of calculations per second (H/s) that a network can perform. To break it down further:

- 1 KH/s = 1,000 H/s

- 1 MH/s = 1 million H/s

- 1 GH/s = 1 billion H/s

- 1 TH/s = 1 trillion H/s

- 1 EH/s = 1 quintillion H/s

When you’re evaluating the hash rate of the Bitcoin network, consider looking at historical trends to see how they’ve fluctuated over time and what that might mean for your investments.

The Impact of Hash Rate on Mining Profitability

Mining profitability is directly tied to hash rate. As the hash rate increases due to more miners joining the network, the difficulty of solving blocks also ramps up to maintain a consistent block time of around 10 minutes.

- Higher difficulty = fewer rewards for miners.

- Mining operations must continually innovate to stay profitable, considering the rising energy costs.

- Utilizing efficient tools, such as ASIC miners, can significantly improve your chances of profitability amidst fluctuating hash rates.

Future Trends and Considerations

According to the latest industry report by Chainalysis, Bitcoin’s hash rate is expected to grow by 20% towards 2025, driven by advancements in mining technology and increased institutional interest. This growth inevitably influences both the trading landscape and investment strategies.

As a potential investor or miner, keep these factors in mind:

- Monitor the hash rate trends regularly.

- Stay informed about technological advancements in mining equipment.

- Be aware of regional regulations that may impact your mining operations or investment activities, especially in emerging markets.

In conclusion, understanding the Bitcoin network hash rate is crucial for anyone engaged in the cryptocurrency landscape, whether you are trading, investing, or mining. By comprehensively assessing this metric, you can make informed decisions and navigate the volatile market successfully.

Take action now — explore our in-depth resources to enhance your knowledge of Bitcoin and secure your investment effectively!

Learn more about cryptocurrency transactions and investment strategies on Hibt.

Article written by Dr. Samuel Rodriguez, a blockchain technology expert with over 15 published papers and a lead auditor for several recognizable cryptocurrency projects.