Bitcoin DeFi Yield Farming: Navigating Opportunities

Bitcoin DeFi Yield Farming: Navigating Opportunities

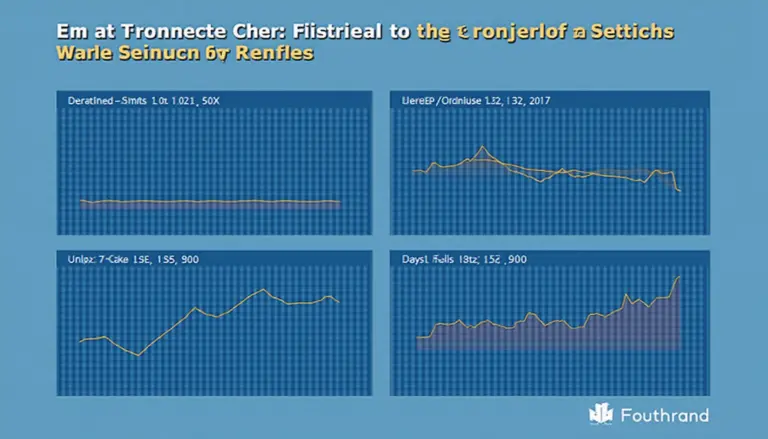

With over $4.1B lost to DeFi hacks in 2024, security remains a paramount concern for crypto investors and enthusiasts. As the decentralized finance (DeFi) landscape evolves, yield farming emerges as a significant avenue for generating passive income through cryptocurrencies like Bitcoin. This concept involves earning rewards by providing liquidity to DeFi platforms, making it a lucrative yet complex endeavor.

Understanding Bitcoin DeFi Yield Farming

Bitcoin DeFi yield farming allows users to earn rewards by lending their assets or providing liquidity in decentralized exchanges. This process is akin to placing money in a high-interest savings account, where the user earns interest over time. According to recent studies, Vietnam’s crypto user growth rate is projected to increase by 25% in 2025, highlighting the rising interest in yield farming among Vietnamese investors.

How Yield Farming Works

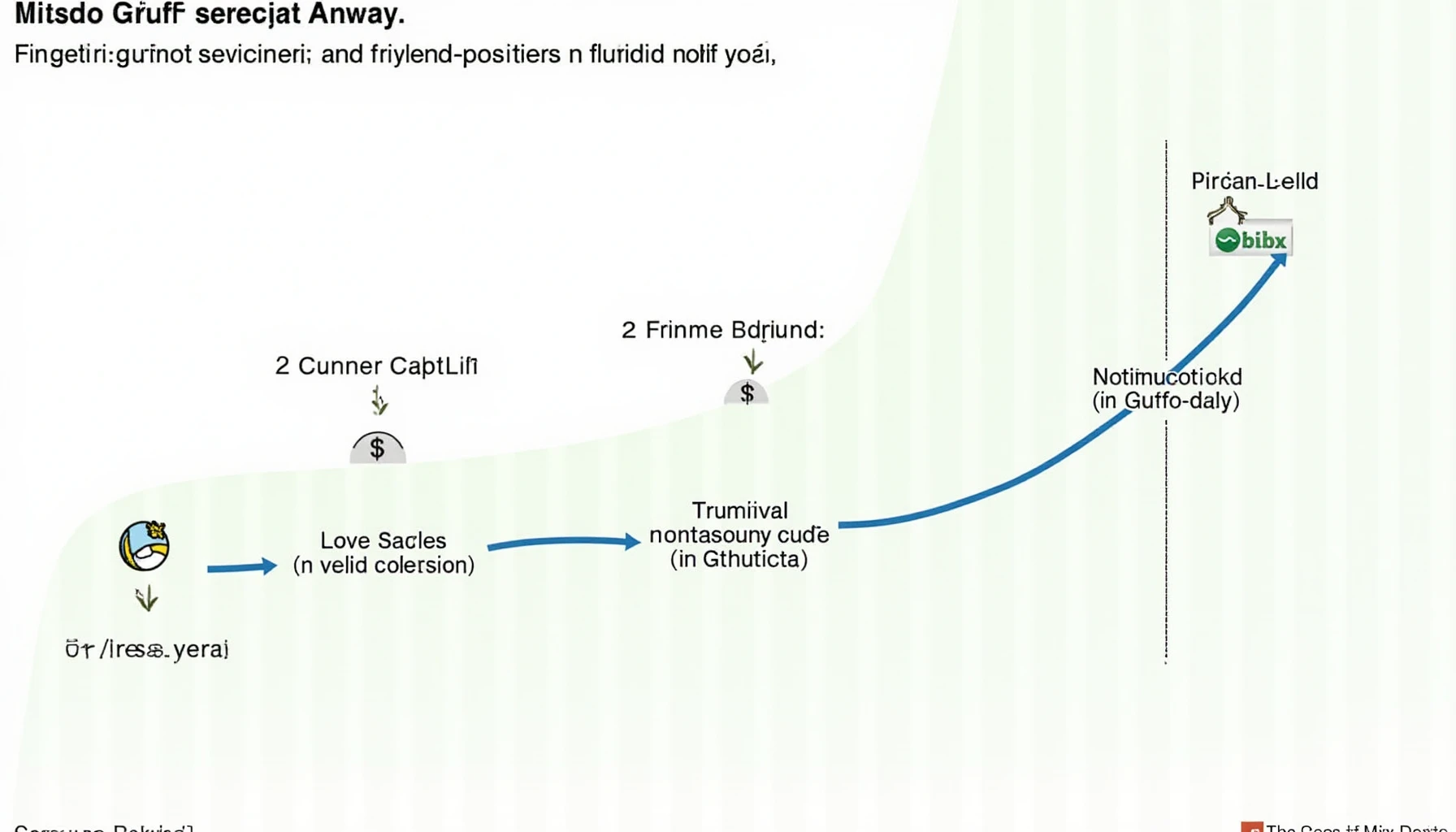

- Users deposit their assets into a liquidity pool.

- Smart contracts automatically manage transactions and distributions.

- Participants earn tokens as rewards, which can be reinvested.

To further understand this process, think of it as a mutual fund where your assets work together with others to generate returns. Yield farming strategies can vary significantly, and users must select which pools to invest in based on their risk tolerance and market conditions.

Risks Associated with Yield Farming

While yield farming has the potential for high returns, it also comes with its share of risks:

- Impermanent Loss: This occurs when the value of deposited assets fluctuates.

- Smart Contract Vulnerabilities: Bugs in the code can lead to significant losses.

- Market Volatility: Changes in cryptocurrency prices can affect overall returns.

Ignoring these risks can be detrimental. Just like investors do their due diligence before engaging with traditional markets, research is essential to navigate the DeFi landscape effectively.

Best Practices for Successful Yield Farming

To mitigate risks and enhance your yield farming experience, consider the following best practices:

- Diversify your investments across multiple pools.

- Regularly monitor your investments and market trends.

- Invest only what you can afford to lose.

Leveraging these strategies can lead to better decision-making and maximized profits. You can also check out hibt.com for additional insights on DeFi security practices.

Conclusion: Why Bitcoin DeFi Yield Farming Matters

In conclusion, as Bitcoin DeFi yield farming continues to gain traction, understanding its dynamics and risks is crucial for every investor. With the right knowledge and strategies, you can capitalize on the potential to earn substantial rewards.

Don’t forget to stay updated on best practices and evolving trends in this space. Interested in broadening your knowledge? Download our security checklist today to guide your investments!

Whether you’re in Vietnam or elsewhere, this booming market offers exciting opportunities for passive income. Always remember to perform due diligence and adapt to changes in the DeFi landscape.

Author: Dr. John Smith, a blockchain technology expert with over 30 published papers and a lead auditor on multiple high-profile projects in the DeFi sector.