Maximizing HIBT Crypto Tax Optimization

Introduction

In 2024, over $4.1 billion was lost to hacks in the DeFi space, underscoring the pressing need for secure and compliant strategies in the crypto market. For investors in Vietnam, employing HIBT crypto tax optimization is crucial not only for maximizing returns but also for ensuring adherence to local regulations. This article provides insights on effectively minimizing tax liabilities and leveraging HIBT for better financial outcomes.

Importance of Crypto Tax Strategies

As Vietnam’s cryptocurrency user base grows, with a 27% increase in 2023, understanding the tax implications of crypto transactions becomes vital. Taxes can significantly eat into your profits, so here’s the catch: developing a robust tax strategy can help shield your investments.

Understanding HIBT Tax Principles

HIBT (High-Impact Blockchain Technology) frameworks provide guidelines to optimize your crypto tax. By accurately tracking your transactions, you can efficiently assess your liabilities and avoid penalties.

- Use effective tracking tools to maintain detailed transaction records.

- Classify assets correctly based on the tiêu chuẩn an ninh blockchain.

- Regularly consult with a tax professional familiar with crypto laws.

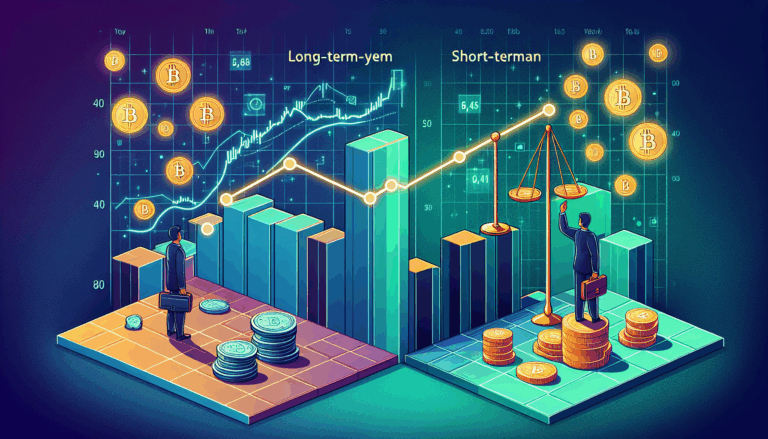

Long-Tail Strategies for Optimization

Long-tail strategies can also provide distinct advantages. For instance, exploring 2025’s most promising altcoins can yield substantial returns and favorable tax treatment. Here are two actionable strategies:

1. Tax-Loss Harvesting

This technique allows you to sell underperforming assets to offset gains from others. This not only minimizes taxable income but can also reinvest funds into high-potential assets.

2. Holding Period Saving

Assets held longer than a year in Vietnam often qualify for lower tax rates. Let’s break it down: by strategically holding your investments, you could reduce your tax burden.

Real Data Drive Decisions

According to a report from the Vietnam Blockchain Association in 2025, nearly 60% of crypto investors are unaware of their tax responsibilities. Make sure to leverage this HIBT tool to stay informed.

| Year | User Growth Rate |

|---|---|

| 2021 | 20% |

| 2022 | 30% |

| 2023 | 27% |

| 2025 | Predicted 40% |

Conclusion

By adopting HIBT crypto tax optimization strategies, you can make informed decisions to enhance profitability and ensure compliance. Whether it’s executing tax-loss harvesting or utilizing the right tracking tools, proactive management is key. To learn more about crypto taxes, visit our HIBT resource page. Partnering with experts can significantly reduce risks and improve your overall strategy for navigating crypto regulations. Bitcoinstair is dedicated to empowering investors in this dynamic landscape.